Tokenization empowers investors and disrupts Wall Street | Opinion

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

“The Times They Are-A Changin”—this classic opening line from one of Bob Dylan’s most endearing songs has become the most appropriate statement when discussing contemporary asset-holding patterns.

You might also like: Crypto and banking: tokenization of the global financial system is yet to come | Opinion

A detailed market study conducted by one of the Big Four accounting firms, Ernst&Young (E&Y), last year pointed towards a significant increase in allocation to digital assets and interest in tokenization. The report revealed that institutional investors were becoming increasingly confident of the long-term value of blockchain and digital assets. According to the E&Y survey, 57% of institutional investors expressed interest in investing in tokenized assets, with 93% of respondents believing in the long-term value of blockchain or digital technology and digital assets.

Interestingly, not only were they keen to tokenize assets, but most had a clear strategy on how to proceed. For instance, 71% of the institutional asset managers surveyed intended to tokenize their assets via partnerships with digital native or tokenization firms. Meanwhile, 21% planned to build infrastructure internally, and 5% looked forward to acquiring a tokenization startup.

What benefits do these seasoned fund managers see that compel them to plan so meticulously for tokenization?

The empowering potential of tokenization

In one of their explainers, McKinsey & Company defines tokenization as the “process of issuing a digital, unique, and anonymous representation of a real thing.” On a practical level, tokenization requires a blockchain on which the process has to be carried out. Institutional investors show a marked preference for public-permissioned blockchains for the tokenization of their assets, followed by private chains (40%) and public chains (22%).

One of the most enticing aspects of tokenization is its inclusivity, allowing for a wide array of assets to be tokenized. These include real estate, art, bonds and equities, intellectual properties, and even identity and data.

There are ample examples of real-world assets getting tokenized and becoming available to an expanded base of new customers and investors. Consider Gold, for instance, which has long been one of the most trustworthy assets throughout human history. Last year, the combined market capitalization of tokenized gold assets surpassed $1 billion.

Tokenized gold involves the physical gold bullion whose ownership rights are stored as digital tokens on a blockchain. While the physical gold remains in secure custody off-chain, protected by financial institutions, those who offer tokenized gold mint digital tokens on a blockchain to signify ownership rights of physical gold bullion or coins. The equivalency—such as one on-chain token representing one gram of physical gold stored off-chain—is determined by the issuing company.

Multiple companies now offer such tokenized gold coins. For example, the New York-based fintech firm Paxos Trust Company offers Pax gold (PAXG) coins, while the well-known blockchain entity Tether offers Tether gold (XAUT).

Like gold, art is another class of asset that has enthusiastically embraced tokenization. For instance, in April 2023, a soon-to-be-launched blockchain platform, Freeport, declared that it had completed its SEC review and was set to launch its tokenized art platform with four iconic Warhols from collectors, including the legendary Baby Jane Holzer. While the platform did not sustain, it made a useful observation in its press release; it said:

“Blockchain technology has opened up access to exclusive investment opportunities that were once out of the reach of the average retail investor, especially today’s younger generation. However, in the case of fine art, the entry bar remains too high for everyday retail investors, leaving them unable to participate in an investment class that has outperformed the S&P 500 over the last 25 years and is often insulated from wider market conditions.”

Freeport was right on target. The world has already witnessed Sygnum Bank’s tokenization of Pablo Picasso’s 1964 masterpiece, Fillette au Beret, which allowed 50 investors to collectively own the artwork through 4,000 tokens. Further exemplifying this shift, renowned artists like Damien Hirst and the celebrated digital artist Beeple have joined the growing chorus of successful painters to embrace tokenization.

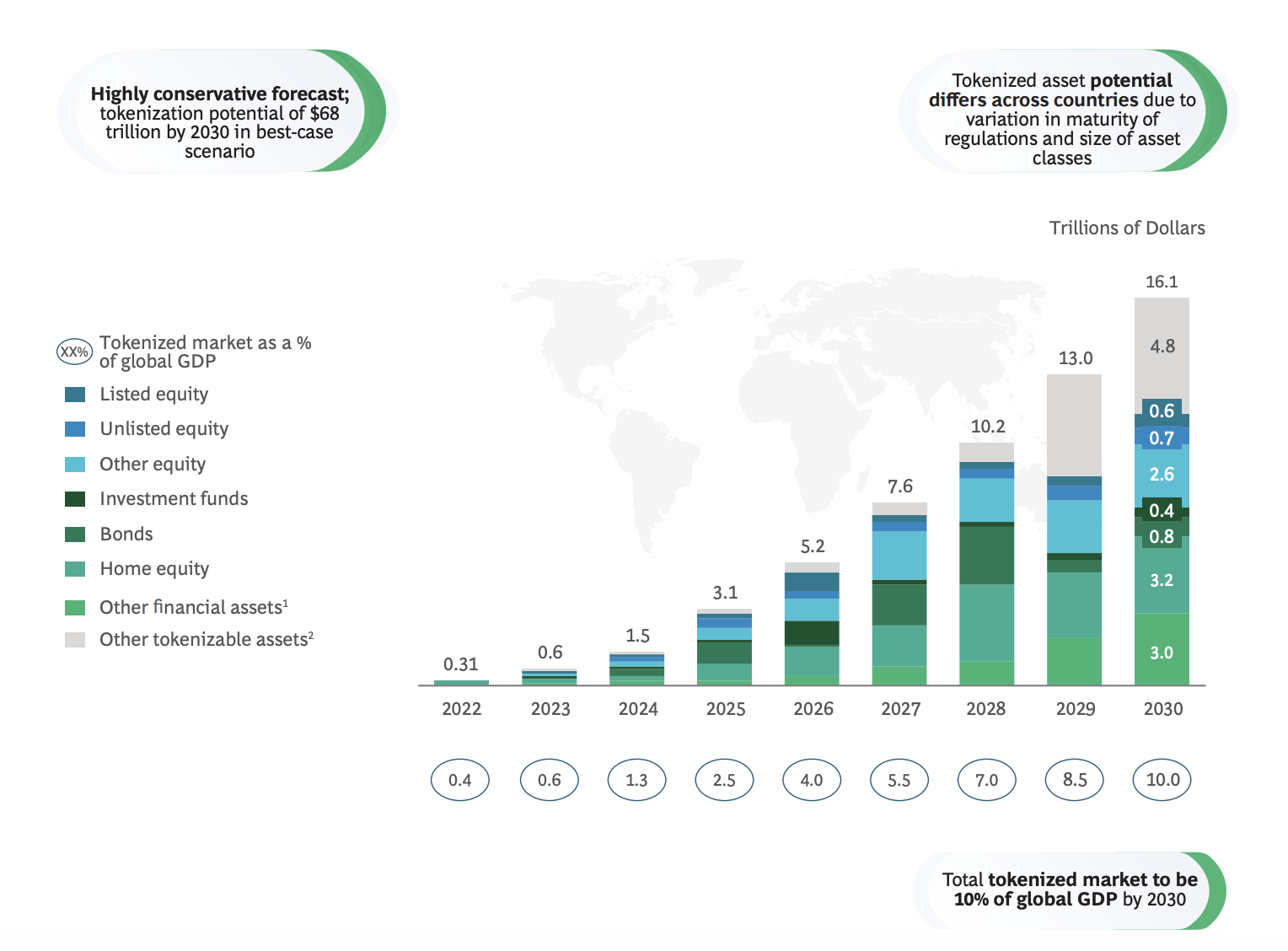

As this trend accelerates, the tokenization of real-world assets is transforming several other asset classes. According to the Boston Consulting Group, the total size of tokenized assets, including the ones considered less liquid, like real estate and natural resources, could cross $16 trillion by 2030.

Tokenization of global illiquid assets by 2030 | Source: Boston Consulting Group

But what underlies this massive surge in value? How is it becoming possible for such a new technology like blockchain to unlock trillions in untapped liquidity? Several factors are driving growth in this market.

The factors that make asset tokenization a winner

One of the primary factors that makes asset tokenization an instant winner is its potential to make asset holding more democratic, equitable, and inclusive. These are the inherent properties of blockchain, which envisions a world free of cost-bearing, prohibitive intermediaries. This vision seamlessly extends into the field of real-world asset tokenization.

Take, for example, high-value art precious metals or real estate, which are typically out of reach for the average retail investor. Thanks to fractionalized ownership via digital tokens, investing in such assets has become more accessible. Imagine 50 investors collectively buying a Picasso masterpiece or shares in a luxury property. Tokenization democratizes the process, allowing buyers to own a slice of something extraordinary.

This innovative approach operates through automated smart contracts within the systematic framework of blockchain protocols, enhanced by cryptographically secure tokens. It effectively dismantles the monopoly of brokers—from local real estate agents to investment honchos sitting and dictating the market from their swanky Wall Street offices. Now, retail investors no longer need their services. They can invest from the comfort of their homes, equipped with just a digital wallet and an internet connection.

Tokenized assets and the potential for democratic ownership also lead to improved price discovery and lowered costs. In return, the market can reach out to a whole new bunch of investors who hesitated to invest in asset classes such as art or luxury real estate. As a result, liquidity increases manifolds.

Asset holding, particularly in categories like real estate, has often been plagued by fraud. Statistically speaking, one in ten Americans has been a target of real estate fraud, with half of these victims even suffering financial losses. Such a scale of real estate fraud is alarming. After all, it results in annual financial losses worth $446 million, with median consumer losses in real estate fraud reaching as high as $70,000 per incident.

Asset tokenization brings enhanced transparency and far tighter security to the system. The confluence of blockchains, smart contracts, and decentralized oracle networks reduces dependency on intermediaries. It becomes much easier to verify the authenticity of the tokenized property as it comes with immutable ownership records stored on a blockchain ledger. These ledgers make provenance tracking possible and come with auditable data trails.

Investing in tokenized assets is also more efficient. Programmable smart contracts help streamline the backend and make the process free from potential administrative lapses. Therefore, it is no wonder that tokenization has been on the rise. Who would not want a more democratic, efficient, inclusive, and cost-efficient investment environment?

The future of tokenization: Innovation and ingenuity

As the market is projected to grow to multi-trillion dollars in the coming years, it will attract innovation and inventive solutions. Interoperability plays a crucial role, bringing isolated systems together under a singular operational paradigm, enhancing scale, transparency and efficiency with enterprise-grade infrastructure and programmable logic.

Tokenization is spreading fast to several areas, including the financial service sector, where cash tokenization is gaining momentum. McKinsey & Company estimates that $120 billion of tokenized cash is in circulation in the form of fully reserved stablecoins. In a world grappling with climate change and global warming, the tokenization of carbon credits offers an innovative solution. These tokens hold all the information and functionality of the credits within them.

Carbon credits can now be issued natively on-chain, making their attributes public. This transparency encourages greater acceptability and adoption, and these credits are transferable onto the blockchain via carbon bridges. These bridges can eventually be connected to traditional registries like Verra and Gold Standard.

The potential of tokenization goes beyond empowerment. Anyone with a digital wallet can participate, regardless of their financial status. Tokenization has democratized access to high-value assets that were once only aspirational—such as a lucrative piece of real estate or an art masterpiece.

Previously, such assets were only available for most investors to admire from afar. Now, through tokenization, investors can own a piece of these assets, even if only partially, and tap into their exceptional growth potential.

What this means is an intermediary-free empowered investor class can now optimize their returns and explore their opportunities as widely as possible, depending on the asset classes they are interested in.

Read more: Real-world assets: 2024 is the breakthrough year for tokenization | Opinion

Cloris Chen

Cloris Chen is the CEO of Cogito Finance, a defi platform offering institutional-grade investment products by tokenizing fixed-income assets and equities. Cloris combines a banking background with hands-on defi experience. She spent six years at HSBC and served as treasury director for a unicorn startup. This diverse experience of the CEO helps Cogito to address challenges in defi, such as unsustainable yield farming, credit risk, and regulatory uncertainty through tokenization. As a SingularityNET partner, Cogito harnesses Ben Goertzel’s AI expertise for the company’s processes, including portfolio management.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Polygon

Polygon  Zcash

Zcash  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Bitcoin Gold

Bitcoin Gold  Ravencoin

Ravencoin  Decred

Decred  NEM

NEM  DigiByte

DigiByte  Ontology

Ontology  Nano

Nano  Waves

Waves  Status

Status  Huobi

Huobi  Lisk

Lisk  Hive

Hive  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom