Toncoin (TON) Active Addresses Fall to 6-Month Low as Telegram Airdrops Hype Fades

For most of the past few months, Telegram airdrops dominated the crypto market, fueling massive growth in Toncoin (TON) network activity. However, active addresses on the TON blockchain have now dropped to their lowest level since April.

But why has this suddenly dropped? This analysis highlights the causes and the potential impact it could have on Toncoin’s price

Telegram Users’ Disappointment Casts Doubt on Toncoin’s Recovery

Between August and September, Toncoin’s active addresses reached notable heights. That surge could be attributed to the launch of several Telegram airdrops, which market participants thought would return profitable gains.

In August, Telegram-native meme coin DOGS distributed over 40 billion tokens to eligible messaging app users. This was followed by the September launch of the widely adopted tap-to-earn mini-app game Hamster Kombat.

However, user reactions to both events revealed widespread dissatisfaction with the value of the airdropped tokens. Despite the hype before the Token Generation Event (TGE), many recipients expressed disappointment with the value of the tokens distributed.

Read more: What Are Telegram Mini Apps? A Guide for Crypto Beginners

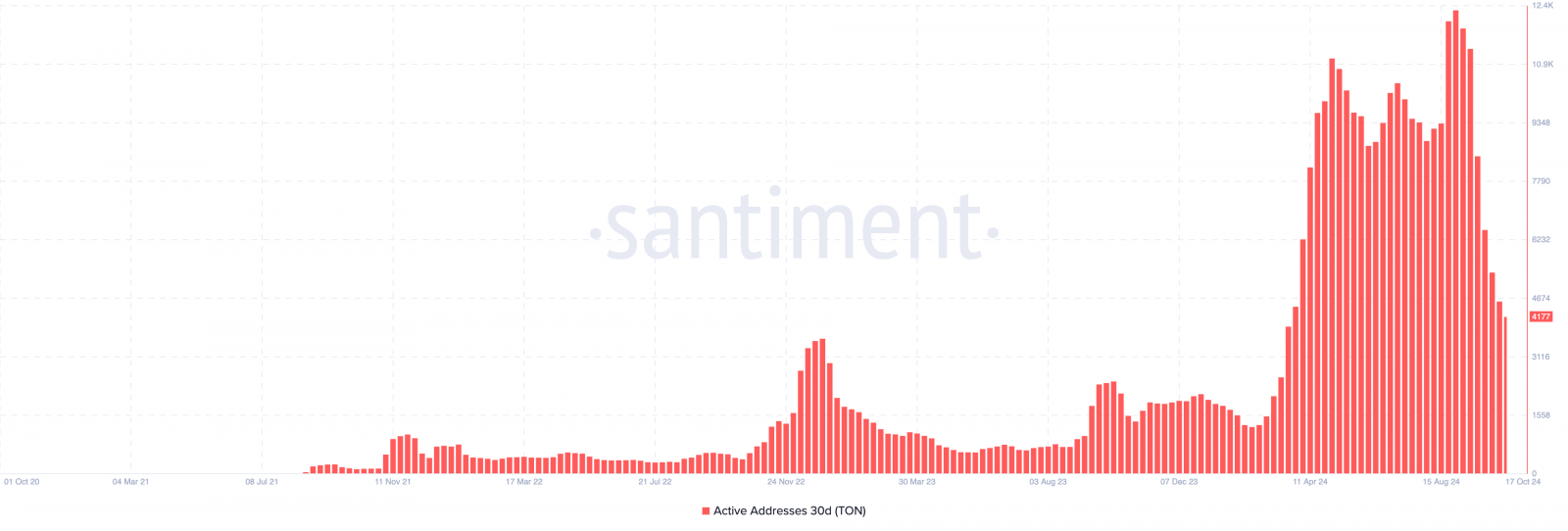

Toncoin Active Addresses. Source: Santiment

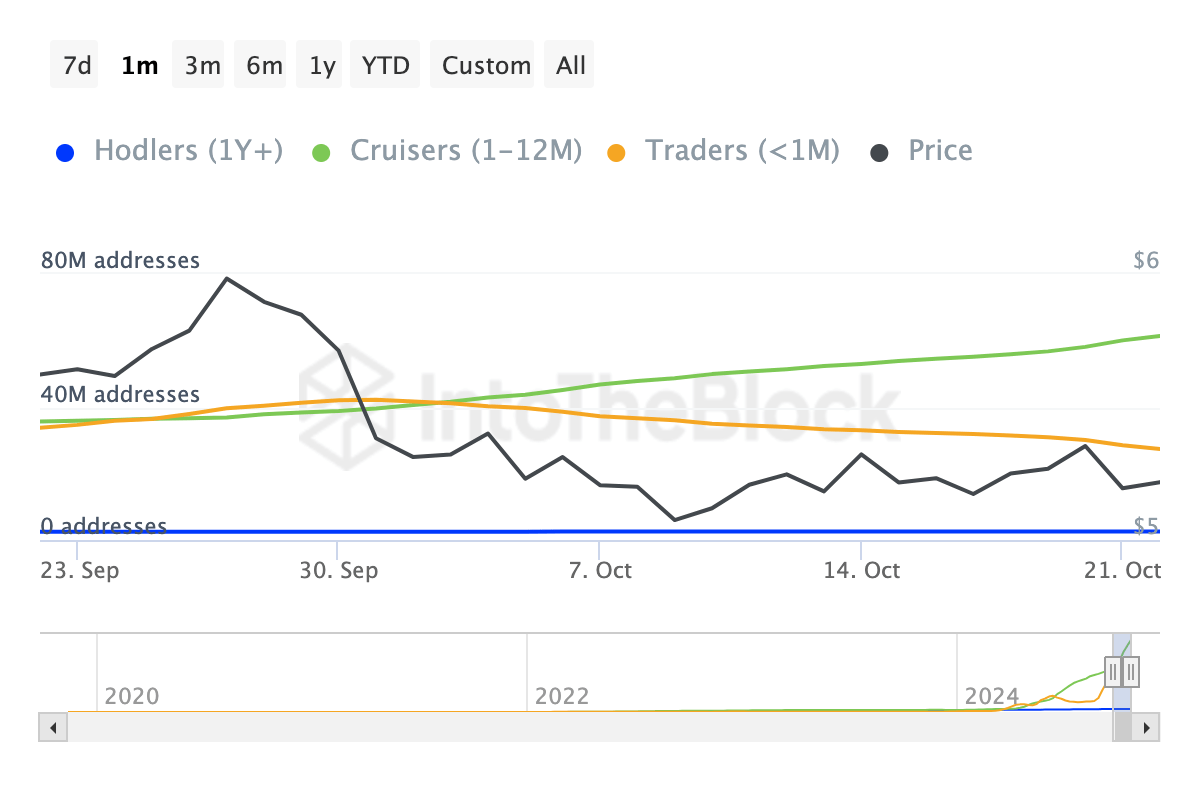

This sentiment likely contributed to the decline in engagement with Toncoin. Besides that, data from IntoTheBlock revealed a decline in the number of short-term holders. In the lead-up to the August and September airdrops, TON experienced a massive increase in the number of short-term holders.

This development fueled speculation that the TON’s price could return to $7. However, the shifting sentiment might have put that prediction to rest, as a shortage of demand might negatively affect the cryptocurrency’s value.

Toncoin Addresses By Time Held. Source: IntoTheBlock

TON Price Prediction: Selling Pressure Could Drive It Down to $4

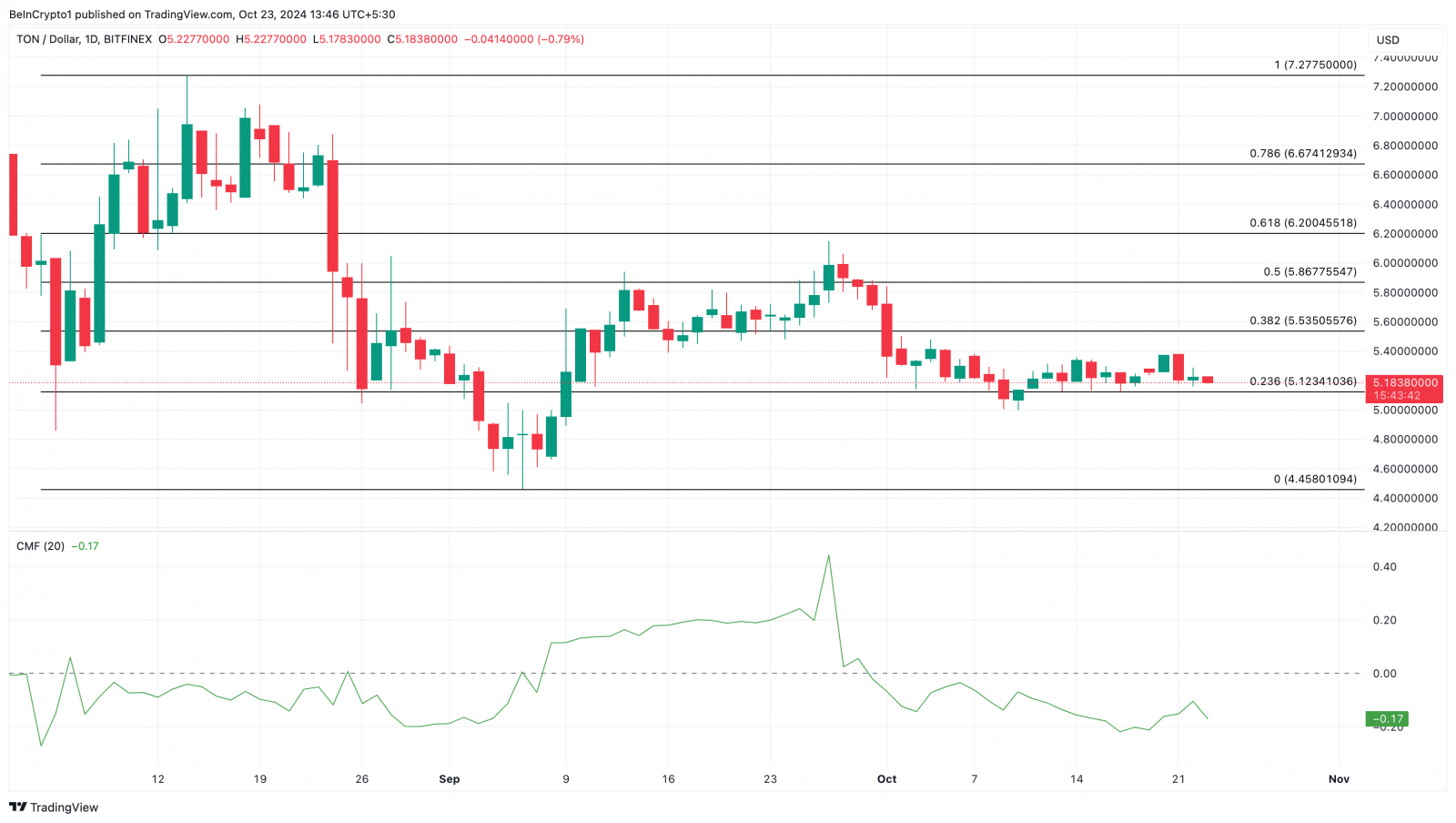

Currently, Toncoin’s price is $5.18, and the daily chart shows that the Chaikin Money Flow (CMF) has been in the negative zone since September 28.

The CMF is a technical indicator used to measure the buying and selling pressure of a security. Its primary function is to help distinguish between periods of accumulation (when investors are actively buying) and distribution (when investors are selling or reducing their positions).

When the CMF is above the zero line, it suggests that there is net accumulation, meaning the asset is experiencing more buying than selling pressure. This can be interpreted as a bullish signal, indicating that investors are confident in the security’s prospects.

Conversely, when the indicator is below the zero line, it signals net distribution, implying increased selling pressure and a potential bearish outlook for the asset. With the current position, Toncoin’s price could experience a decrease to $4.46.

Read more: 6 Best Toncoin (TON) Wallets in 2024

Toncoin Daily Price Analysis. Source: TradingView

However, if the upcoming Telegram airdrops slated for October bring in good value, this prediction could change. In that scenario, demand for TON might increase as the price could rally to $6.20.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  Tezos

Tezos  KuCoin

KuCoin  IOTA

IOTA  NEO

NEO  Zcash

Zcash  Polygon

Polygon  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Qtum

Qtum  Siacoin

Siacoin  Basic Attention

Basic Attention  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  DigiByte

DigiByte  Ontology

Ontology  Nano

Nano  Status

Status  Hive

Hive  Waves

Waves  Huobi

Huobi  Lisk

Lisk  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom