Top Analyst Predicts Bitcoin Price Correction to $63K, Best Time to Sell Meme Coins

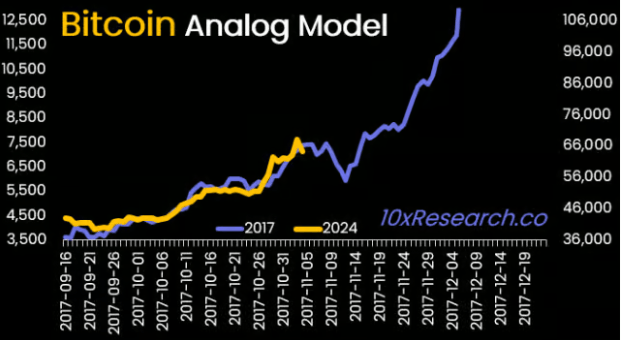

Markus Thielen, chief executive officer of 10x Research, on Saturday predicted Bitcoin price risks dropping to $63,000 amid new cautious outlook. He also said meme coins mania has now ended and investors must look to book profits. He is one of the first few analysts who accurately predicted a BTC price retracement to $38,000 post-spot Bitcoin ETF approval.

Bitcoin and Ethereum Prices Can Retrace Further

Top analyst Markus Thielen in a newly released report disclosed reasons behind the recent fall in Bitcoin and Ethereum prices. The concerns related to upcoming correction were evident due to the weak Bitcoin market structure after Bitcoin rallied to new ATH amid low trading volumes and liquidity.

Unpredictable market and volatility amid US inflation and jobs data, MicroStrategy shares trading at 60-90% overvalued relative to its Bitcoin holdings and returns indicated high odds of correction. Moreover, central bank officials are reluctant to rate cuts further dampening market sentiment.

Markus Thielen predicts BTC price fall to $63,000 before resuming further rally amid slow spot Bitcoin ETF inflows despite low GBTC selling. Other analysts have also made similar Bitcoin price predictions indicating further fall before bitcoin halving.

Source: 10X Research

Meanwhile, Ethereum is also showing fundamental weakness after the Dencun upgrade, with Layer 2 chains to dilute Ethereum’s yield. In addition, odds of spot Ethereum ETF approval at 30% and weak technical chart patterns shows a consolidation or a further pullback in ETH price.

ETH price currently trades at $3,730, down 0.5% in the last 24 hours and 6% in a week. The trading volume has dropped by 25% in the past 24 hours.

Also Read: Bitcoin ETF Records $2.5B Weekly Inflows, BTC Price Correction Looms Near FOMC?

Meme Coins Rally Has Topped

Bitcoin ETFs continue to provide support driven by confident buying by BlackRock clients, which also triggered rally in meme coins, especially Shiba Inu. South Korea’s trading volume increased in last few weeks, but most of the trading volume has now faded.

In fact, altcoin rallies are closely tied to Ethereum’s bullish momentum. With rising uncertainty, altcoins including meme coins may have reached a short-term peak and prices risks falling. Also, South Korea’s meme coin trading volume drop hints at end of meme coin mania and start of a broader correction.

CoinGape recently reported that a whale dumped 1 trillion SHIB tokens to a crypto exchange amid broader market selloff.

Also Read: Bitcoin SOPR Data Shows Major BTC Price Consolidation for March

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Polygon

Polygon  Zcash

Zcash  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Bitcoin Gold

Bitcoin Gold  Ravencoin

Ravencoin  Decred

Decred  NEM

NEM  DigiByte

DigiByte  Ontology

Ontology  Nano

Nano  Waves

Waves  Status

Status  Huobi

Huobi  Lisk

Lisk  Hive

Hive  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom