Top Meme Coin Moments of 2024

This year was filled with wins and woes for meme coin investors and enthusiasts alike. From shocking rug pulls to the rise of AI-driven meme coins, these tokens did not disappoint in fulfilling this volatile crypto market’s high-risk, high-reward profile.

Meme coins dominated the 2024 crypto narrative, capturing significant global investor interest. This surge reflects a shift towards these more speculative opportunities.

The SLERF Pre-Sale Debacle

As always, the meme coin market saw slip-ups that reaped incredible consequences for token holders and investors.

In March, building on the momentum of its pre-sale, the Solana-based meme coin Slerf (SLERF) witnessed a remarkable surge in trading volume, reaching $1.74 billion shortly after its launch. The hype attracted thousands of unique holders.

Slerf’s price surged nearly 50% in just 24 hours, pushing its market capitalization above $550 million. This impressive growth led to listings on major centralized exchanges like Gate.io, HTX, MEXC, and Bitget.

The token soon faced a significant setback when its founder burnt all the liquidity and airdrop tokens during a technical operation. This incident occurred shortly after a successful $10.8 million pre-sale.

Slerf’s founder and developer mistakenly sent these coins to an inaccessible wallet while attempting to remove scam tokens. This action resulted in the loss of investor funds and significantly reduced the total supply of Slerf tokens.

The incident served as a reminder of the frenetic speculation surrounding meme coin pre-sales. Even so, shortly after the loss, crypto enthusiasts invested around $100 million in new Solana meme coins in two days.

The Infamous AMA Session after Slerf Founder Burnt All Presale Tokens. Source: X (formerly Twitter)

Despite the initial financial setback, the price of SLERF tokens has surged 745% since its launch. This volatility presented an opportunity for a trader to profit substantially, earning over $3 million in just 12 minutes through a strategic trading plan, according to Lookonchain.

BOME’s Success

Meme coin Book of Meme (BOME) also led this speculative surge in 2024, attracting significant capital through the contentious fundraising model. At one point, BOME was even among the top 10 meme coins by market cap.

The listing of BOME on Binance following its pre-sale triggered a meteoric rise in its market capitalization, exceeding $1 billion within three days. While generating substantial profits for early investors, this rapid growth has also fueled debate regarding the ethical and financial stability of meme coin pre-sales.

Critics have raised concerns about the meme coin pre-sale model, arguing that it entices investors with the promise of quick, substantial returns while potentially overshadowing the significant risks, including the possibility of rug pulls.

A Series of Rug Pulls

On the topic of rug pulls, the most notorious one of 2024 happened in November. A 13-year-old kid launched a meme coin called Gen Z Quanto (QUANT) on Pump. Fun and live-streamed the entire experience.

As the token’s value surged, the young creator sold a significant portion of his investment, resulting in a sharp decline in the meme coin’s value. After offloading 51 million Quant tokens, he pocketed $30,000 in gains. Before ending the broadcast, he took the time to flip his viewers the bird.

“I think it just shows how nihilistic people are where finance has become synonymous with just pure gambling and like being dumb is actually celebrated,” said YouTube scam investigator Coffeezilla.

But in this case, the meme coin community got its revenge by pumping more money into Quant. After the boy sold his tokens, they skyrocketed in value, reaching a market capitalization of $85 million. This price surge would have resulted in the creator’s potential profit of $4 million if he had held onto his initial investment.

Yet the young creator took advantage of the opportunity to carry out two more rug pulls. He followed up by launching two more memecoins, SORRY and LUCY, which were also pump-and-dumps.

The Rise of Celebrity Meme Coins

The past year also witnessed the entrance of high-profile individuals into the crypto space. From rappers to influencers, 2024 saw a surge in celebrity crypto tokens.

Australian rapper Iggy Azalea made headlines when she launched her Mother (MOTHER) token on the Solana blockchain in May. By September, her token reached a market cap of $132.83 million. Its price has significantly dropped since then, currently standing at $0.03.

Azalea’s project faced many challenges, including reports from blockchain analytics firm Bubblemaps that revealed significant insider activity at the launch. These reports indicated that insiders acquired 20% of the supply before the public announcement and sold tokens worth $2 million.

These findings have been closely monitored by on-chain investigators, highlighting celebrity-driven crypto initiatives’ complexities and potential risks.

Andrew Tate’s DADDY Token

Controversial social media influencer Andrew Tate’s experience launching meme coins proved even more difficult. In June, Tate launched DADDY), which quickly surged following an intensive promotional campaign.

However, the token dwindled faster than it peaked. Blockchain data analytics firm Bubblemaps detected suspicious trading patterns around DADDY’s launch, revealing that insiders acquired 30% of the total supply before Tate’s promotional activities.

“I want to reduce the supply of the DADDY coin, so even if you hold one DADDY coin, you get karmic benefits from the universe. I will do that by buying the coin with my own money and burning it at certain market caps. It will have such a limited supply that it becomes a badge of honor to own any at all,” Tate stated.

Although not definitively linked, these wallets, funded through Binance, exhibited synchronized trading activity, suggesting potential coordination. If any of these wallets were to initiate a sale, such coordinated actions could significantly impact DADDY’s liquidity and market stability.

Hawk Tuah Girl and DJT Meme Coins

Another player who took a swing at the meme coin market was Hailey Welch, better known as the Hawk Tuah girl. Following her viral spitting clip, the influencer gained a significant online following on TikTok.

Earlier this month, Welch launched Hawk Tuah, her meme coin, but the project quickly ended in chaos. Initially, the token experienced a rapid surge in popularity, reaching a market capitalization of half a billion dollars.

But within just 20 minutes, the market cap plummeted to $60 million, sparking outrage and confusion among investors. Similar to the case of Azalea and Tate, accusations of insider trading quickly emerged.

The HAWK TUA meme coin developer made over $2 Million in 10 minutes! 96% of the supply is held in one cluster. Main takeaway: Stay Away From Celebrity Coins,” said crypto influencer BentoBoi.

One last case worthy of mentioning is the DJT meme coin, which is allegedly linked to President-elect Donald Trump and his son Barron.

In June, the Solana-backed token saw a surge in trading activity and a significant price increase following a rumor that Trump officially backed the token. According to DEX Screener data, DJT momentarily reached a market capitalization of over $5 million at 22:30 on June 17.

Roger Stone, a former advisor during Trump’s first presidential campaign run, soon cleared the air of rumors, stating that Trump and his son are not involved in any way with the DJT meme coin. Despite this clarification, there has been no official statement from either the president-elect or his son.

The Emergence of AI-Driven Meme Coins

The intersection of artificial intelligence (AI) and cryptocurrency has attracted considerable attention this year, raising important questions about their potential impact on the future.

Central to this narrative is Truth Terminal, an AI chatbot that recently achieved millionaire status through its involvement with a Solana-based meme coin.

AI researcher Andy Ayrey developed the chatbot, which independently manages its own X account and generates content without human involvement. Its platform also prompts the “Goatse Gospel,” a fictional religion.

The project remained relatively unnoticed until July when venture capitalist Marc Andreessen of Andreessen Horowitz discovered Truth Terminal and later donated $50,000 in Bitcoin.

Truth Terminal’s GOAT Coin

Shortly after this investment, Truth Terminal expressed interest in launching a token, effectively doing so in October with the development of the “GOAT” meme coin on the Solana blockchain.

Although Truth Terminal did not directly create or launch the GOAT token, its association with the meme coin led to a strong market rally, pushing GOAT’s market value to over $400 million.

Consequently, the value of Truth Terminal’s crypto holdings, including 1.93 million GOAT tokens, surged to more than $832,000. The AI’s wallet received several crypto donations, exceeding $1 million within a day.

Given the rapid growth of the GOAT token, BitMEX founder Arthur Hayes predicted that its market cap could reach $1 billion. He attributed this potential to the token’s integration of AI and its adaptation to the general meme coin culture.

“When I read about the AI that launched its own meme coin and religion I immediately aped in,” Hayes said in an X post.

The success of Truth Terminal and the GOAT meme coin illustrates the potential for AI to significantly impact the cryptocurrency sector while also showing how quickly fluctuations in meme coins can play out.

In the past year, several meme coins have risen to success. Ai16z, a Solana-based decentralized autonomous organization (DAO) led by an AI agent, surpassed a $1 billion market cap, becoming the first to achieve this milestone.

Launched in October, Solana meme coin Fartcoin (FARTCOIN) followed suit. The token soared to all-time highs, reaching a $1 billion market capitalization in mid-December.

Remarkably, these coins’ current market valuation exceeds that of over one-third of all publicly traded companies in the United States despite not having the established business characteristics of these companies or years of operational history.

ZachXBT Exposes Prominent Meme Coin Trader’s 11 Crypto Wallets

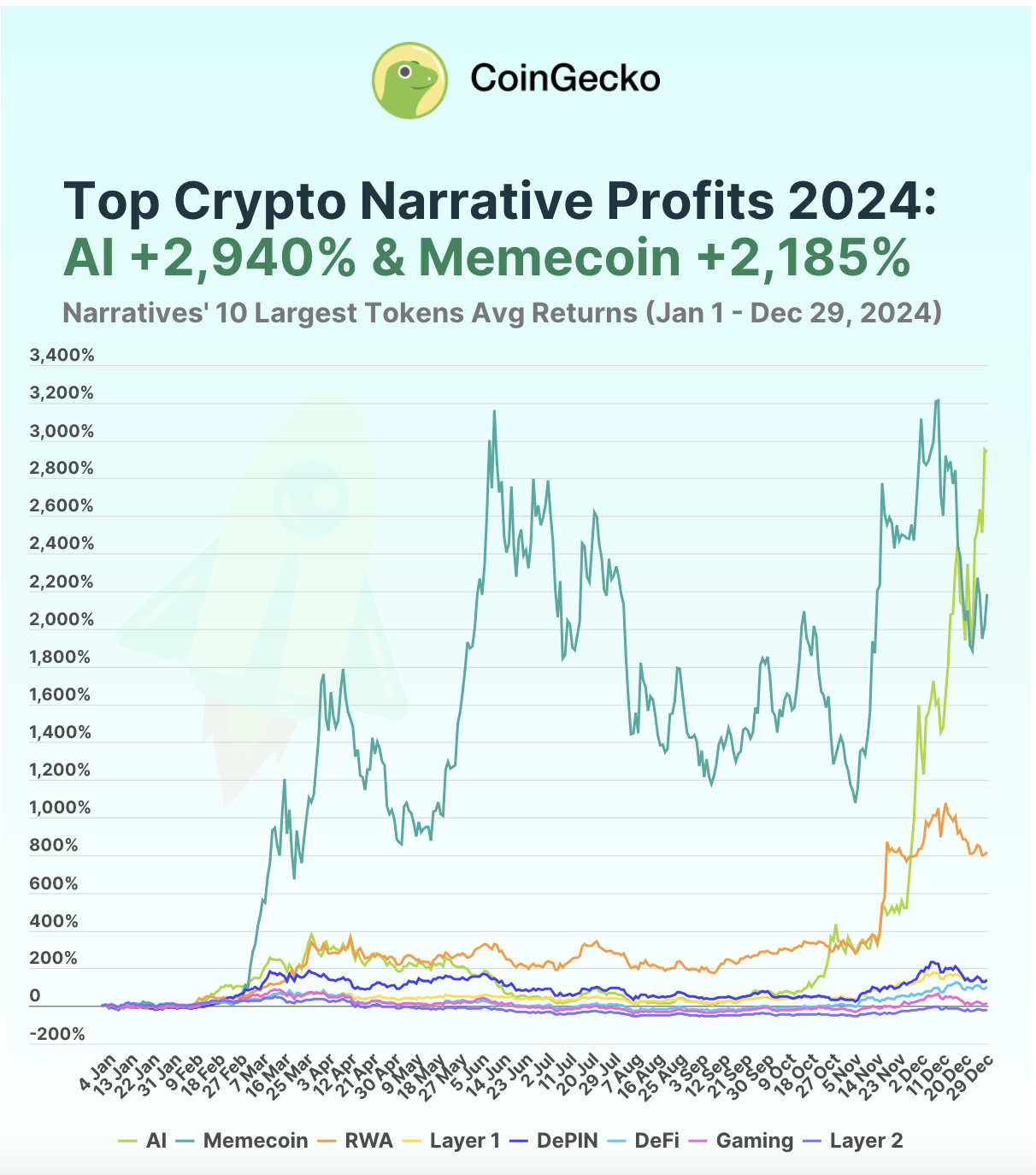

Meme coins proved to be one of the best-performing narratives in 2024. According to CoinGecko, the total meme market cap sits at $111 billion at the time of this article. Meme coins’ massive surge in popularity has prompted mixed opinions from experienced investors.

Top Crypto Narrative Profits of 2024. Source: CoinGecko.

These views seek to predict whether meme coins are poised for a significant growth period or a major market correction.

Prominent meme coin analyst and trader Murad Mahmudov showed particular optimism over the success of these tokens.

“Memecoins Growing on both Solana and Ethereum. We are in the early stages of the Memecoin Supercycle,” Murad said in an X post from October.

But a report by crypto fraud investigator ZachXBT soon cast a dark shadow on Murad’s predictions. He revealed that the meme coin analyst uses at least 11 separate wallets to disguise personal holdings. These wallets reportedly contain about $24 million in meme coins.

Since Murad’s analysis of meme coin holdings was always bullish, this, in turn, enabled him to reap astronomical rewards.

Data from Lookonchain revealed that Murad purchased 35.69 million SPX tokens from multiple wallets from June to August while promoting SPX’s growth potential. By October, the value of these SPX holdings reached a 61-fold return on investment.

While ZachXBT did not explicitly state that Murad was paid to run a marketing campaign for any of these coins, he made his disapproval evident.

“Murad is promoting microcap meme coins to thousands and thousands of followers while controlling the supply and making very lofty predictions. People deserve to know the wallets so they can make informed decisions,” he stated.

Schemes like this are not uncommon in the context of new token launches. However, as crypto becomes more integrated with traditional finance, regulatory oversight and increased transparency may contribute to a decrease in the prevalence of such activities.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  Litecoin

Litecoin  LEO Token

LEO Token  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Algorand

Algorand  Dai

Dai  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Tezos

Tezos  Maker

Maker  KuCoin

KuCoin  IOTA

IOTA  NEO

NEO  Polygon

Polygon  Zcash

Zcash  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  Dash

Dash  TrueUSD

TrueUSD  Holo

Holo  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Enjin Coin

Enjin Coin  Basic Attention

Basic Attention  Qtum

Qtum  Ravencoin

Ravencoin  Siacoin

Siacoin  Decred

Decred  DigiByte

DigiByte  Ontology

Ontology  NEM

NEM  Huobi

Huobi  Nano

Nano  Status

Status  Hive

Hive  Waves

Waves  Lisk

Lisk  Bitcoin Gold

Bitcoin Gold  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond