Traders Anticipate Cardano (ADA) Price Rebound as Loss-Trimming Bets Spikes

Cardano (ADA) derivatives traders seem confident that the altcoin’s price will soon recover much of its recent losses, according to data obtained by BeInCrypto from Coinglass.

ADA, like many cryptocurrencies, has faced challenges over the past few days, currently trading at a seven-day low of $0.35. Despite the underwhelming market conditions, these traders appear unfazed. The question remains: Will their optimism prove to be the right call?

Confidence in Cardano Recovery Hit Extreme Heights

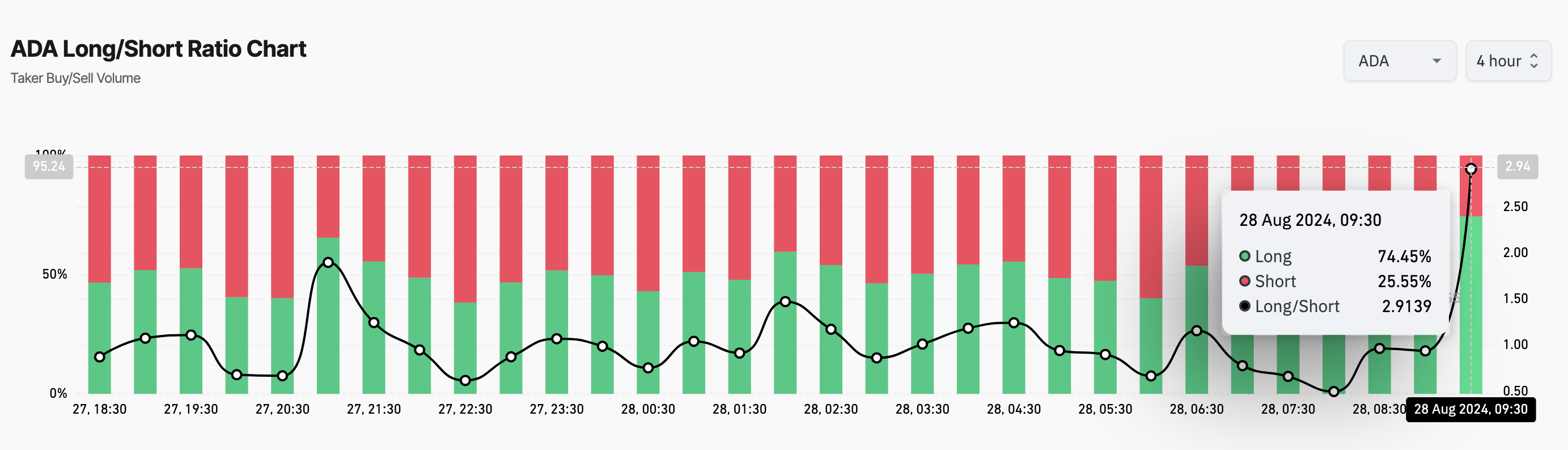

According to data from the derivatives information portal Coinglass, the 4-hour Long/Short ratio for Cardano (ADA) currently stands at 2.91. The Long/Short ratio measures the buying volume (longs) relative to the selling volume (shorts) on futures contracts.

This ratio provides insight into market sentiment among traders. A ratio below 1 indicates bearish sentiment, while a value above 1 suggests that more traders are taking long positions, expecting the price to rise.

For Cardano, the current ratio indicates that nearly 75% of traders holding ADA-related contracts expect the price to rebound, while only 25% anticipate another decline. This strong bias toward long positions reflects optimism among traders that ADA will recover from its recent downturn.

Read more: 9 Best Blockchain Protocols To Know in 2024

Cardano Long/Short Ratio. Source: TradingView

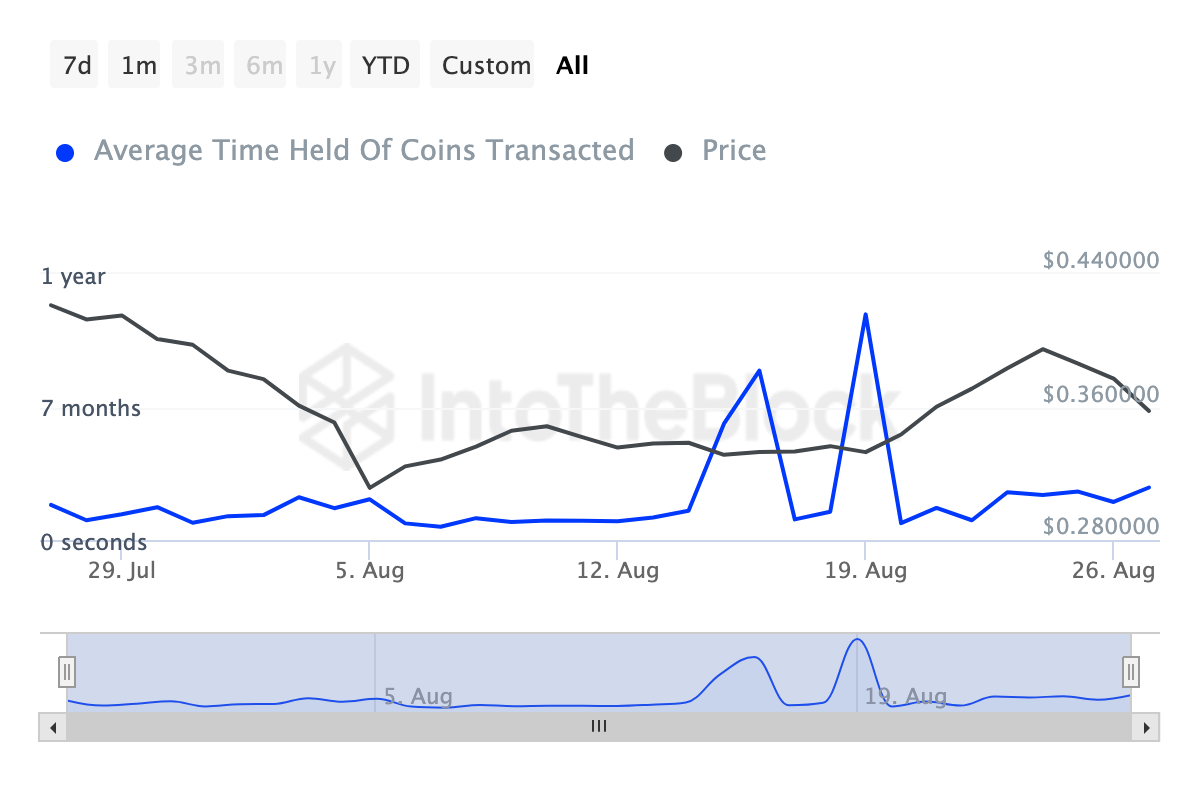

However, it’s not just traders in the derivatives market who are optimistic about ADA’s potential recovery. On-chain data from IntoTheBlock suggests that ADA holders are also confident that the altcoin will regain its losses.

To provide context, BeInCrypto examines the Coins’ Holding Time, a metric that tracks how long a cryptocurrency has been held without being sold or transacted. When this metric decreases, it indicates that holders are selling.

In ADA’s case, the Coins Holding Time has increased by 64% over the past seven days and by an impressive 103% over the last 30 days. This rise suggests that holders are maintaining their positions, which could help stabilize ADA’s price and prevent another downturn — barring any unforeseen negative developments in the market.

Cardano Coins Holding Time. Source: IntoTheBlock

ADA Price Prediction: Bulls Need to Defend Key Support

While Cardano’s price has dropped 15% since Saturday, the Moving Average Convergence Divergence (MACD) indicator suggests that relief might be on the horizon. The MACD is a technical oscillator that helps traders identify buying and selling trends and gauge momentum.

A negative MACD indicates bearish momentum, while a positive reading signals bullish momentum. In Cardano’s case, the positive value of the MACD, despite the recent price decline, suggests a bullish divergence. If this divergence holds, it could precede a price increase.

However, there are crucial levels to monitor. For ADA to confirm the bullish outlook, it needs to stay above $0.34. If it fails to do so, a deeper correction to $0.31 could occur. On the other hand, if bulls defend the $0.34 region, ADA could start an upward move toward $0.39 in the short term.

Read more: Cardano (ADA) Price Prediction 2024/2025/2030

Cardano Daily Analysis. Source: TradingView

Meanwhile, a significant price decrease could spark massive long liquidations and potentially drive a long squeeze. For those unfamiliar, a long squeeze happens when traders expecting a price increase are forced to sell to prevent further losses.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Stellar

Stellar  Litecoin

Litecoin  Cronos

Cronos  Hedera

Hedera  Ethereum Classic

Ethereum Classic  Dai

Dai  Monero

Monero  Stacks

Stacks  OKB

OKB  Cosmos Hub

Cosmos Hub  Algorand

Algorand  Theta Network

Theta Network  Maker

Maker  KuCoin

KuCoin  Gate

Gate  Tezos

Tezos  Polygon

Polygon  NEO

NEO  Tether Gold

Tether Gold  Zcash

Zcash  IOTA

IOTA  Synthetix Network

Synthetix Network  Bitcoin Gold

Bitcoin Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Holo

Holo  0x Protocol

0x Protocol  Siacoin

Siacoin  Enjin Coin

Enjin Coin  Dash

Dash  Ravencoin

Ravencoin  Qtum

Qtum  Basic Attention

Basic Attention  Decred

Decred  Ontology

Ontology  NEM

NEM  Lisk

Lisk  DigiByte

DigiByte  Waves

Waves  Status

Status  Nano

Nano  Numeraire

Numeraire  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy