Tronix potential short setup as the price drops below a key support level

TRX/USDT trading strategy

- Buy/sell asset: SELL TRX/USDT

- Entry price: 0.1400

- Stop loss: 0.1423

- Leverage: 3x

- Take profit 1: 0.1370

- Take profit 2: 0.1350

- Take profit 3: 0.1319

- Timeframe: 1-2 weeks

- Maximum profit: 5.75%

- Maximum loss: 1.63%

TRX/USDT chart and technical analysis

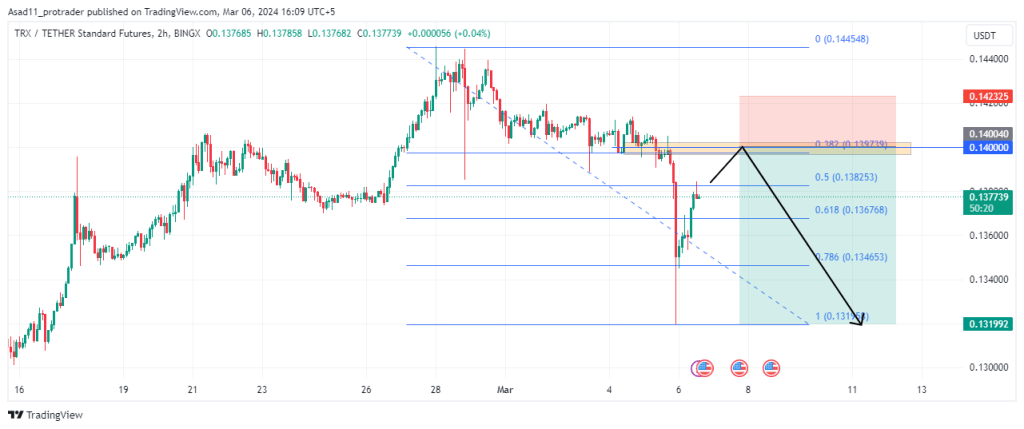

TRX/USDT yesterday dropped below the key support of 0.1375 and closed below this level. The recent drop was mainly driven by the massive sell-off after the BTC/USD reached an all-time high. The price has been in a bullish trend for the last 4 months, however, the market structure has turned bearish after yesterday’s drop. The price made long bearish candles with imbalances and fair value gaps which indicates the bears are taking control.

The price is likely to drop further after making a correction and will probably retrace back to the 0.1400 resistance level before the drop. The 0.1400 is a key resistance and is around the 0.382 Fibonacci level from where the price is likely to drop further.

I am considering the 0.1400 resistance level for sell entry and my target for this trade would be the recent low of 0.1319. The price is likely to continue the bearish trend for an extended period.

Tronix fundamental analysis

Fundamentally, the greed index is extremely high and the sell-off will possibly continue for quite some time and the price of TRX/USDT is likely to keep dropping.

Tronix to Tether trade idea takeaways

- TRX/USDT is likely to drop as the market structure has turned bearish.

- The price will probably drop to the 0.1319 support in the coming days.

- Multiple take-profit levels have been added to secure profit along the way.

- The risk-to-reward ratio on this trade is 1:3.5.

- The entry and stop-loss prices have been placed at secure levels with the least probability of getting hit.

- Good luck!

The post Tronix potential short setup as the price drops below a key support level appeared first on Invezz

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Tezos

Tezos  Maker

Maker  KuCoin

KuCoin  IOTA

IOTA  NEO

NEO  Polygon

Polygon  Zcash

Zcash  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Zilliqa

Zilliqa  Holo

Holo  0x Protocol

0x Protocol  Enjin Coin

Enjin Coin  Basic Attention

Basic Attention  Qtum

Qtum  Siacoin

Siacoin  Ravencoin

Ravencoin  Hive

Hive  Decred

Decred  NEM

NEM  DigiByte

DigiByte  Ontology

Ontology  Bitcoin Gold

Bitcoin Gold  Huobi

Huobi  Nano

Nano  Status

Status  Waves

Waves  Lisk

Lisk  Steem

Steem  Numeraire

Numeraire  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond