U.S. economist warns Kamala Harris’s plan could skyrocket inflation

After United States President Joe Biden withdrew from the race for his re-election, replaced by his Vice President Kamala Harris, her planned economic policies, deemed even more radical than the current President’s, have attracted scrutiny and criticism, including from a popular economist.

Specifically, Peter Schiff has criticized Harris’s proposed economic plan as increasing inflation, arguing that inflation is not the solution but rather the opposite, as he explained in an X post published on August 30.

Indeed, as Schiff pointed out:

“Kamala Harris’s economic plan can be summarized in one word: inflation. That’s the only ‘solution’ she offers for every problem she promises to solve. But inflation isn’t the solution; it’s the problem. That means a Pres. Harris would make every problem she hopes to solve worse.”

What Harris’s economic plan includes

As a reminder, Harris has pledged to continue pushing for Biden’s tax reform program, which would raise the upper limit to capital gains taxes from 37% to 39.4% and, if she more closely implements the original scheme, to 44.6%, as Finbold reported on August 28.

She would also raise the corporate tax rate to 28%, which, like the program’s other aspects, could impact investors across markets due to its progressive nature, meaning the more one earns, the more they pay, like the unrealized gains tax that would apply to individuals with a net worth above $100 million.

As a result, taxing unrealized gains could drive capital out of the U.S. to more tax-friendly countries “at an unprecedented rate, leading to a loss of tax revenue and a weakening of our financial system,” according to the article by investment management firm U.S. Global Investors posted on August 26.

Inflation as a consequence

Furthermore, inflation could be one of the consequences of Harris’s future policies, as corporations traditionally offload their costs to customers, sometimes out of necessity and other times to protect their executives’ pay packages. If companies take this route, many Americans could see their expenses increase.

At the same time, Harris supports price controls, a type of government regulation that imposes limits on how much prices and wages can increase, which can assume the form of price ceilings, like rent controls, or price floors, like minimum wage laws, which U.S. Global Investors referred to as a “Band-Aid on a bullet wound.”

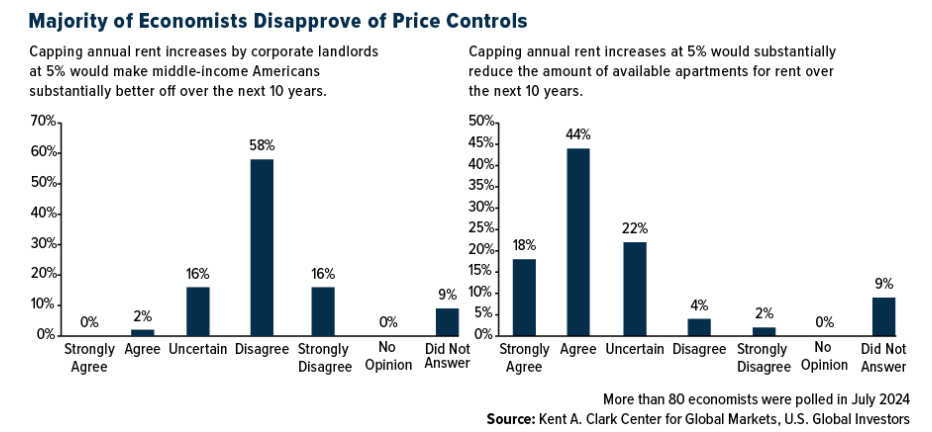

Moreover, citing a July survey, the investment manager stressed that 75% of economists “either disagreed or strongly disagreed with the statement that capping rent hikes at 5% annually would help Americans over the long run,” adding that “62% either agreed or strongly agreed that controlling price increases would lead to ‘substantial’ supply shortages.”

On the other hand, Harris’s opponent in the presidential race, former U.S. President Donald Trump, has offered an array of ideas to halt inflation, including stopping illegal immigration, which he believes would reduce demand for housing and bring down prices, stating in his June speech in Wisconsin:

“Less than four years ago, our borders were secure, inflation was nowhere. (…) I will end the Biden inflation nightmare and we will end it quickly. (…) I will also stop inflation by stopping the invasion, rapidly reducing housing costs.”

All things considered, economists’ concerns regarding Kamala Harris’s planned policies increasing inflation might, indeed, be justified, and only time will tell whether she adjusts her plans accordingly or keeps insisting on them.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Polygon

Polygon  Zcash

Zcash  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  DigiByte

DigiByte  Ontology

Ontology  Nano

Nano  Status

Status  Waves

Waves  Huobi

Huobi  Lisk

Lisk  Hive

Hive  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom