UAE Dominates Global Crypto Adoption, Vietnam Surges to Second

Cryptocurrency adoption is surging globally, with the UAE and Vietnam leading the way, according to new data from Triple-A.

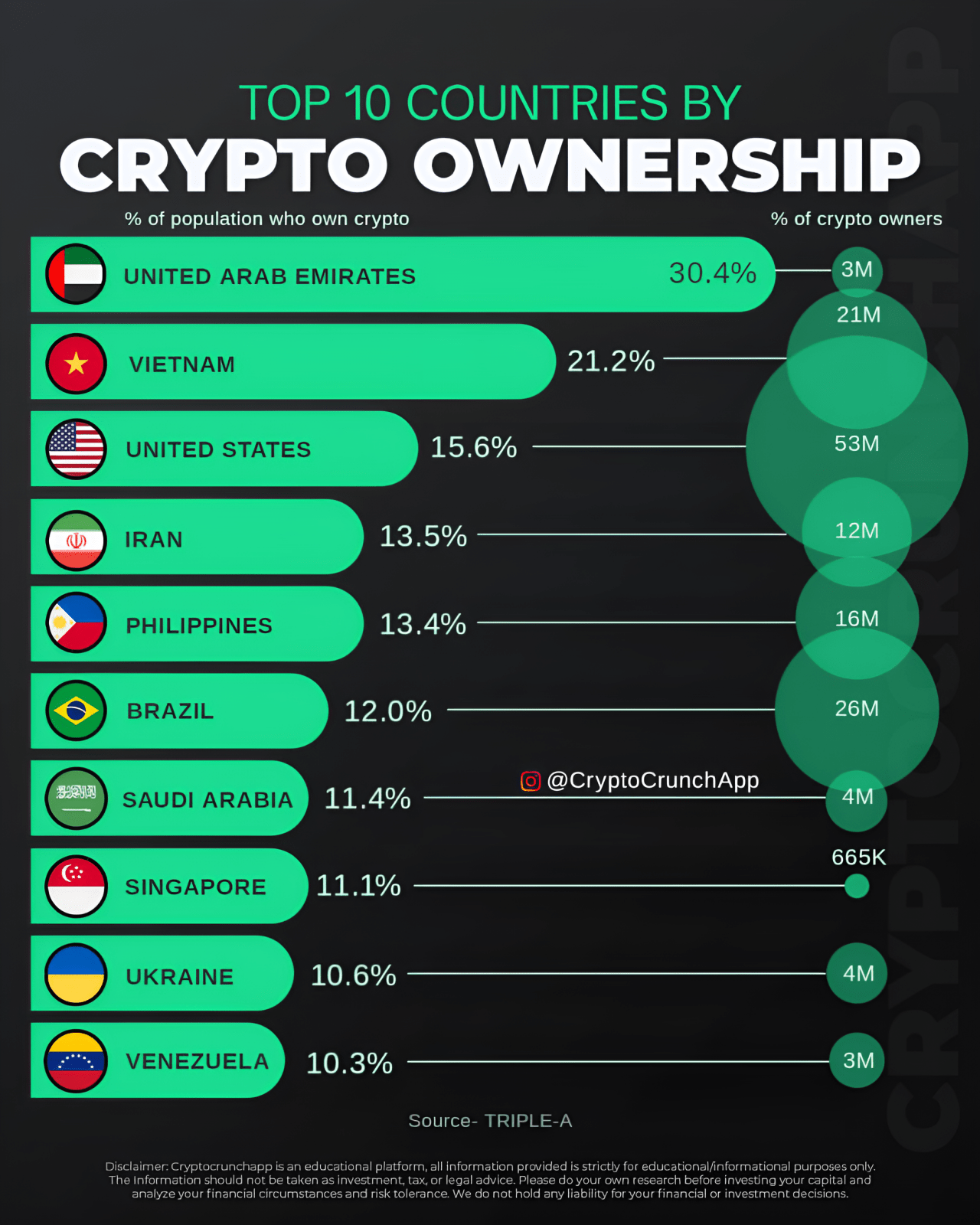

Data from Triple-A reveals the UAE leads the world in cryptocurrency adoption, with over 30% of its population, approximately 3 million people, owning digital assets. This reflects the nation’s forward-thinking embrace of financial technology and its aspirations to become a major fintech hub.

Holding the second spot is Vietnam, where 21.2% of the population, or about 21 million people, are involved with digital currencies. This substantial engagement demonstrates the preference for investment diversification among Vietnamese citizens.

Notably, Vietnam, the only top South Asian nation, outranks Singapore, despite the latter’s status as a developed nation. With traditional investments perceived as less accessible or rewarding, cryptocurrencies offer new avenues for wealth creation.

With 15.6% of its citizens holding cryptocurrencies, the United States ranks third. Nearly 53 million Americans have invested in the crypto market, demonstrating robust growth in one of the world’s largest economies. Notably, the nation was the first to approve both Bitcoin and Ethereum ETFs despite stringent regulatory challenges.

Iran and the Philippines follow, with adoption rates of 13.5% and 13.4%, respectively. Iranians’ participation, despite strict regulatory regimes, indicates a strong interest in leveraging digital assets for wealth creation.

Brazil and Saudi Arabia, with adoption rates of 12% and 11.4% respectively, point to a strong inclination towards cryptocurrencies as viable financial assets. Meanwhile, Singapore, with only 11.1% of its population engaged with cryptocurrencies, reflects its cautious approach despite being a major financial hub. This may also suggest that the market is gradually maturing at its own pace.

Other notable mentions are Ukraine and Venezuela, with adoption rates of 10.6% and 10.3%, respectively. As more individuals and nations embrace digital assets, the global financial landscape is set to expand further, driving financial inclusion and innovation across borders.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Dai

Dai  Monero

Monero  Ethereum Classic

Ethereum Classic  Stellar

Stellar  Stacks

Stacks  OKB

OKB  Cronos

Cronos  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Theta Network

Theta Network  Gate

Gate  KuCoin

KuCoin  Maker

Maker  Algorand

Algorand  Polygon

Polygon  NEO

NEO  EOS

EOS  Tether Gold

Tether Gold  Tezos

Tezos  Zcash

Zcash  TrueUSD

TrueUSD  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Holo

Holo  0x Protocol

0x Protocol  Zilliqa

Zilliqa  Dash

Dash  Siacoin

Siacoin  Ravencoin

Ravencoin  Enjin Coin

Enjin Coin  Basic Attention

Basic Attention  Qtum

Qtum  Decred

Decred  Ontology

Ontology  NEM

NEM  Lisk

Lisk  Nano

Nano  Numeraire

Numeraire  Pax Dollar

Pax Dollar  DigiByte

DigiByte  Waves

Waves  Status

Status  Hive

Hive  Huobi

Huobi  Steem

Steem  BUSD

BUSD  Ren

Ren  OMG Network

OMG Network  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD