Uniswap outlook: what $18B in trading volume means for UNI price

Uniswap Protocol saw its monthly L2 volume soaring to $18.23 billion this month, eclipsing the $7.34 billion recorded in 2023.

Source – Uniswap’s LinkedIn post

The staggering surge indicates massive activity and robust growth in the UNI ecosystem.

Such an environment supports impressive price actions for UNI in the upcoming sessions, with bulls targeting extending rallies to $12.01.

The altcoin traded at $7.95 on Thursday after yesterday’s rejection at a crucial resistance of $8.26.

Source – Coinmarketcap

A successful closing beyond this hurdle could trigger notable rallies for the altcoin, bolstered by improved whale activity and technical indicators.

UNI eyes a 51% jump

The native token has struggled to overcome the resistance at $8.24. It faced another rejection on Wednesday, which catalyzed the brief plunge to press time prices of $7.95.

A break past the obstacle could catalyze a smooth move to $8.37, opening the path for a 10% uptick to the 0.618 FIB retracement at $9.23.

Increased bullish actions at this mark would propel UNI toward $12.01.

That would translate to a 51.06% price increase from the current values.

However, failure to overcome $8.26 would catalyze declines.

Bears will likely target a close beneath the weekly support barrier at $7.08, welcoming possible dips toward mid-September lows of $6.30.

Meanwhile, whale activity and technical indicators support UNI’s upside stance

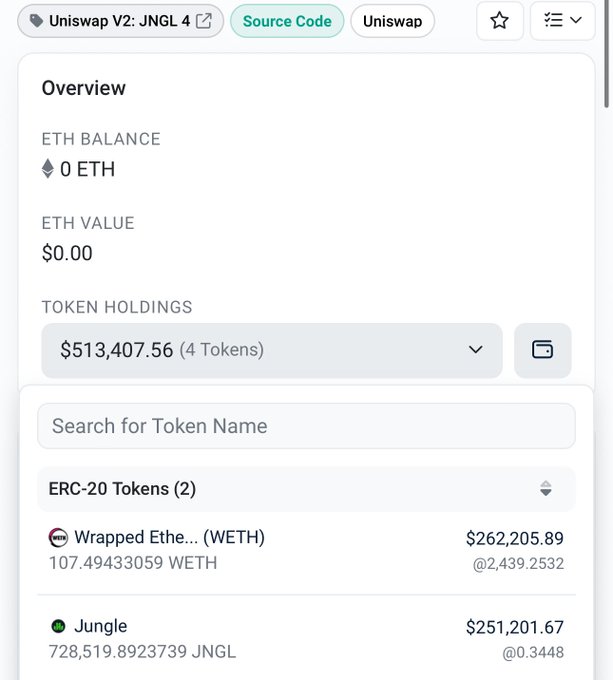

Uniswap has witnessed improved appetite from large-scale investors, with whales accumulating and staking. That underscores their confidence in the asset’s potential future.

Now only 7.2% of supply remaining in UniSwap. Whales are buying up supply and staking. Preparing for the next move.

5:32 AM · Oct 12, 2024 Read 98 replies

Dip-pocketed crypto players go for tokens with robust potential to rally in the coming times.

The Relative Strength Index supports this narrative. At 57 on the daily chart, the RSI sways within the neutral region but leans toward buyer favoritism.

Furthermore, the Moving Average Convergence is crossing above the signal line on the daily timeframe, confirming imminent uptrends.

Meanwhile, enthusiasts should consider Uniswap exchange reserves.

The metric saw a slight dip to 58.2 in the past day according to CryptoQuant.

Source – CryptoQuant

An increase in reserves often signals magnified selling momentum, while a decline means vice versa.

Meanwhile, UNI traders should remain vigilant as the altcoin remains poised for significant swings.

Coinglass shows the asset saw around $144.4K in short positions and $27.3K in longs liquidated in the latest event.

Such an imbalance might trigger swift price movements upon sudden shifts in market conditions.

In conclusion, Uniswap’s massive monthly volume increase and promising technical indicators suggest a bullish bias for the altcoin.

The current momentum could trigger solid recoveries for UNI in the upcoming sessions or weeks. The altcoin seems to have what it takes for a double-digit surge to the $12 value area.

The post Uniswap outlook: what $18B in trading volume means for UNI price appeared first on Invezz

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Polygon

Polygon  Zcash

Zcash  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Enjin Coin

Enjin Coin  Qtum

Qtum  Siacoin

Siacoin  Basic Attention

Basic Attention  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  Ontology

Ontology  DigiByte

DigiByte  Nano

Nano  Status

Status  Hive

Hive  Huobi

Huobi  Lisk

Lisk  Waves

Waves  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom