Uniswap price is poised for a rally if it breaks above the ascending triangle pattern

- Uniswap price is squeezed between the boundaries of an ascending triangle; a breakout signals a bullish move ahead.

- On-chain data shows a bullish bias as UNI’s Exchange Flow Balance is negative, and the exchange supply decreases.

- A daily candlestick close below $5.54 would invalidate the bullish thesis.

Uniswap (UNI) price trades inside an ascending triangle pattern; a breakout signals a rally ahead. This bullish move is further supported by UNI’s on-chain data, which shows a negative Exchange Flow Balance and decreasing exchange supply, hinting at a rally ahead.

Uniswap price looks set to resolve ascending triangle to the upside

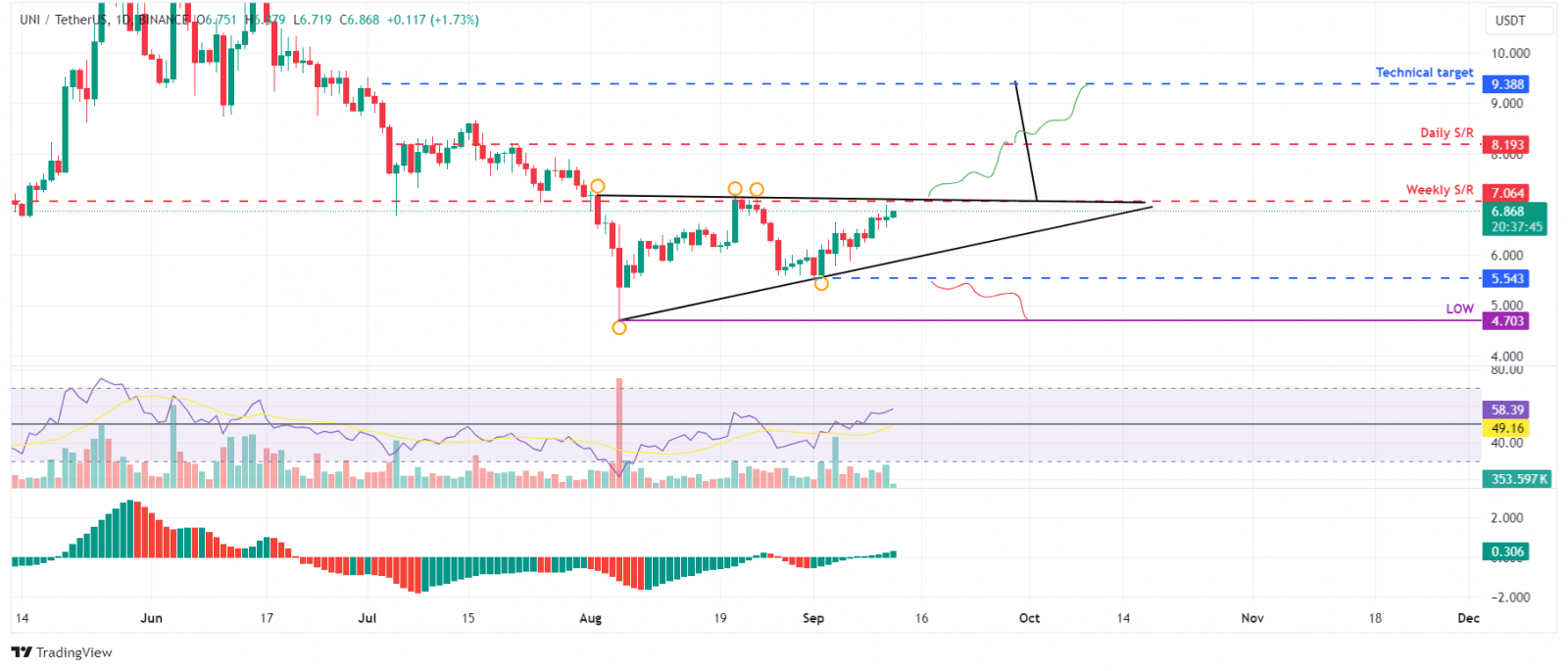

Uniswap price has produced two higher lows and three roughly equal highs since August 2. Connecting these swing points using a trend line reveals an ascending triangle formation in the daily chart. This technical pattern has a bullish bias, and the target is generally obtained by measuring the distance between the first swing high and the first swing low to the breakout point. At the time of writing on Thursday, it trades 1.75% higher, inside the ascending triangle at $6.86.

Assuming the breakout happens by closing a daily candlestick above the weekly resistance at $7.06, adding the 35% measurement to the potential breakout level of $7.06 reveals a target of $9.38. Investors should be cautious of this theoretical move as it could face a slowdown at Uniswap’s daily resistance level of $8.19 and could book some profits at $8.19. However, since the Relative Strength Index (RSI) and Awesome Oscillator (AO) indicators on the daily chart are firmly above their respective neutral levels of 50 and zero, the possibility of a slowdown above is unlikely.

UNI/USDT daily chart

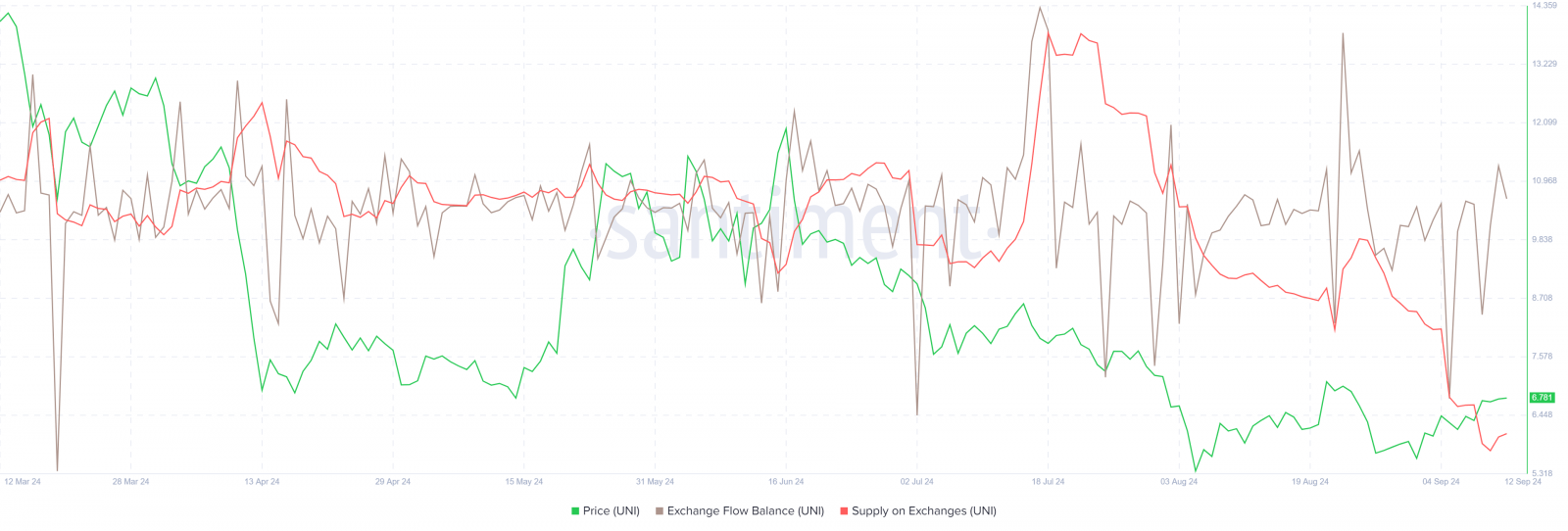

Santiment’s Exchange Flow Balance shows the net movement of Uniswap tokens into and out of exchange wallets. A positive spike indicates more tokens have entered than exited, suggesting selling pressure from investors. Conversely, a negative value indicates more tokens left the exchange than entered, indicating less selling pressure from investors and holders accumulating the asset.

In the case of UNI, this metric slumped from 12,250 to -1.85 million from September 4 to September 5 and from 7,015 to -1.05 million from Sunday to Monday. This negative shift indicates increased buying activity among investors.

During this event, the Uniswap Supply on Exchanges declined by 4.7%. This is a bullish development, as holders remove UNI from exchanges and hold it in cold wallets, further denoting investor confidence in Uniswap.

Uniswap Exchange Flow Balance and Supply on Exchange chart

Despite the bullish thesis signaled by both on-chain data and technical analysis, if UNI breaks the upward trendline of the triangle and closes below $5.54, the outlook would shift to bearish. This scenario could lead to a crash of 16% to $4.70, a daily low of August 5.

Share: Cryptos feed

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Dai

Dai  Cronos

Cronos  Monero

Monero  Ethereum Classic

Ethereum Classic  Stellar

Stellar  Stacks

Stacks  OKB

OKB  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Maker

Maker  KuCoin

KuCoin  Theta Network

Theta Network  Gate

Gate  Algorand

Algorand  Polygon

Polygon  NEO

NEO  EOS

EOS  Zcash

Zcash  Tezos

Tezos  Tether Gold

Tether Gold  Synthetix Network

Synthetix Network  TrueUSD

TrueUSD  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Holo

Holo  Dash

Dash  0x Protocol

0x Protocol  Zilliqa

Zilliqa  Siacoin

Siacoin  Enjin Coin

Enjin Coin  Ravencoin

Ravencoin  Qtum

Qtum  Basic Attention

Basic Attention  Decred

Decred  Ontology

Ontology  NEM

NEM  Lisk

Lisk  Nano

Nano  Numeraire

Numeraire  Waves

Waves  Pax Dollar

Pax Dollar  DigiByte

DigiByte  Status

Status  Hive

Hive  Huobi

Huobi  Steem

Steem  BUSD

BUSD  Ren

Ren  OMG Network

OMG Network  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD