US Bitcoin ETFs Close In on Satoshi’s BTC Stash, Holding 924,768 BTC

Since Jan. 11, 2024, twelve U.S. spot bitcoin exchange-traded funds (ETFs) have been steadily accumulating bitcoin (BTC). This doesn’t include the hefty BTC stash held by Grayscale’s GBTC, which has experienced a total outflow of $20 billion. Right now, these bitcoin funds hold an impressive 924,768.09 BTC, and if they continue scooping up BTC at their current pace, they could surpass Satoshi Nakamoto’s famous 1 million BTC in just over a month.

U.S. Bitcoin ETFs Accumulate 4.68% of Global Supply

This handful of ETFs have certainly been busy since they launched eight months ago. Current data shows that these 12 funds now hold about 4.68% of the total 19.76 million bitcoins in circulation, amounting to a whopping 924,768.09 BTC—valued at over $60 billion based on today’s exchange rates.

When these funds first hit the market, Grayscale’s GBTC was sitting on over 620,000 BTC, but now it holds 220,820.34 BTC. That’s a substantial reduction, with more than $20 billion worth of bitcoin leaving Grayscale’s trust, likely ending up in the hands of the newer spot bitcoin ETFs.

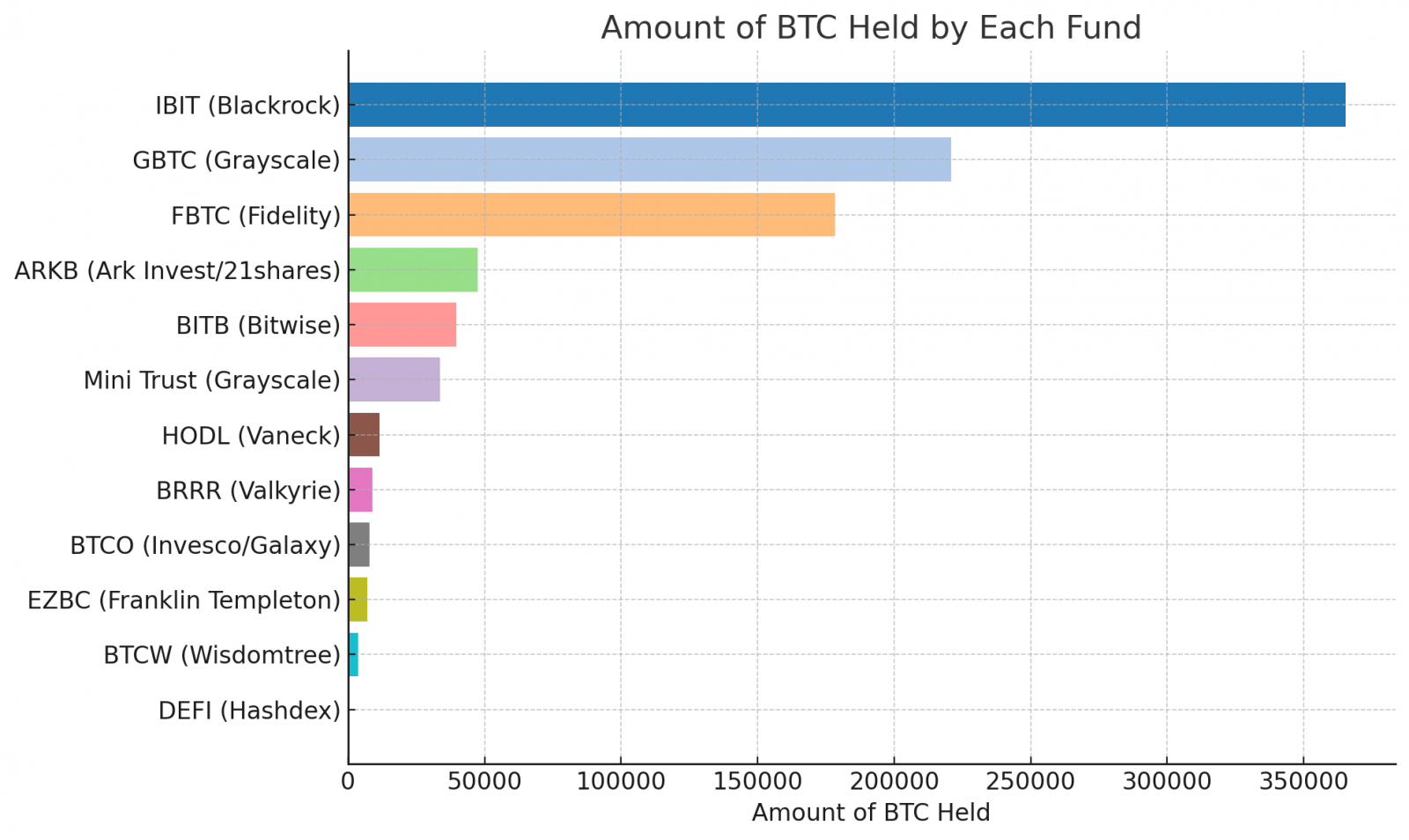

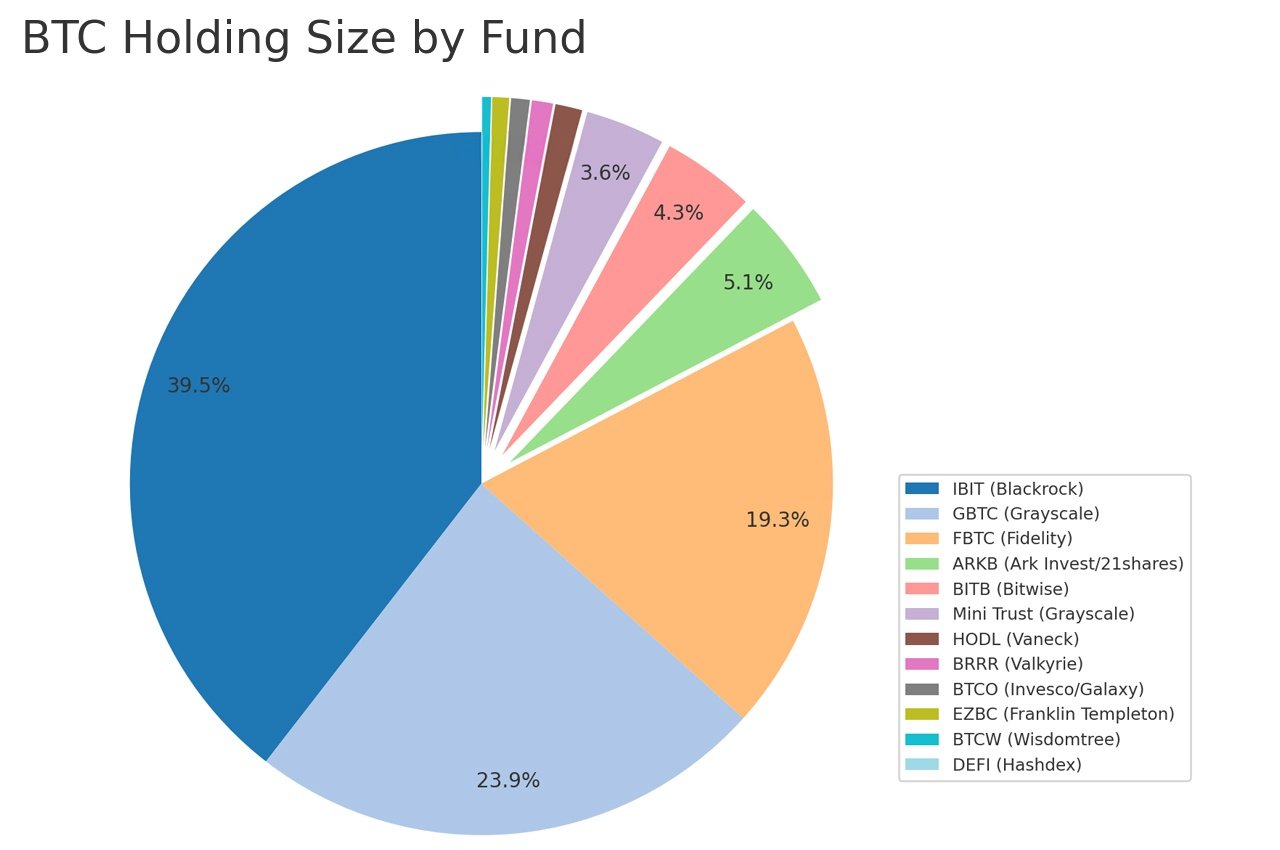

Blackrock’s ETF, IBIT, now boasts a hefty 365,310.38 BTC—making up a solid 39.5% of the total 924,768.09 BTC held by the 12 funds. That means IBIT alone accounts for 1.85% of all the bitcoins currently in circulation. Grayscale’s GBTC, while still significant, holds the second-largest position among these ETFs with 220,820.34 BTC in its reserves.

The numbers reveal that GBTC commands 23.88% of all bitcoin held by the funds, which translates to 1.12% of the 19.76 million bitcoins circulating globally. Hot on Grayscale’s heels is Fidelity’s FBTC, sitting on 178,334.14 BTC.

This gives FBTC 19.28% of the total held by all 12 funds and 0.90% of the circulating bitcoin supply. The remaining ETFs each hold under 50,000 BTC. Leading the pack is Ark Invest and 21shares’ ARKB fund with 47,599 BTC, followed by Bitwise’s BITB at 39,588.07 BTC.

Not far behind is Grayscale’s Bitcoin Mini Trust, which currently manages 33,752.77 BTC. The other ETFs hold even smaller bitcoin reserves. Vaneck’s HODL leads this group with 11,482.53 BTC, followed by Valkyrie’s BRRR at 8,982.53 BTC.

Invesco and Galaxy’s BTCO comes in with 7,941 BTC, while Franklin Templeton’s EZBC manages 7,103.85 BTC. Lower on the list, Wisdomtree’s BTCW holds 3,705.48 BTC, and Hashdex’s DEFI wraps things up with just 148 BTC in its portfolio.

Now it’s widely believed that Satoshi Nakamoto mined 1 million BTC, and with 924,768.09 BTC already in the funds, they’re closing in on this legendary figure. Since Jan. 11, Grayscale’s GBTC shed around 400,000 BTC. Subtracting that from the total leaves 524,768.09 BTC.

If these funds traded every day (which they don’t) over the eight-month span, they’ve been accumulating at a rate of 65,596.01 BTC per month, or 2,154.60 BTC daily. At this pace, the 1 million BTC milestone could be hit in just over a month—roughly 34.8 days. Even with potential fluctuations in the trading pace and inflows or outflows, there’s still a strong chance they’ll cross that threshold sometime in 2024.

What do you think about the 12 spot bitcoin ETFs closing in on 1 million coins? Share your thoughts and opinions about this subject in the comments section below.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Dai

Dai  Monero

Monero  Stellar

Stellar  Ethereum Classic

Ethereum Classic  Stacks

Stacks  Cronos

Cronos  OKB

OKB  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Maker

Maker  Theta Network

Theta Network  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Polygon

Polygon  NEO

NEO  EOS

EOS  Zcash

Zcash  Tether Gold

Tether Gold  Tezos

Tezos  Synthetix Network

Synthetix Network  TrueUSD

TrueUSD  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Holo

Holo  Dash

Dash  0x Protocol

0x Protocol  Zilliqa

Zilliqa  Siacoin

Siacoin  Enjin Coin

Enjin Coin  Ravencoin

Ravencoin  Basic Attention

Basic Attention  Qtum

Qtum  Decred

Decred  Ontology

Ontology  NEM

NEM  Lisk

Lisk  Numeraire

Numeraire  Nano

Nano  Pax Dollar

Pax Dollar  DigiByte

DigiByte  Waves

Waves  Status

Status  Hive

Hive  Huobi

Huobi  Steem

Steem  BUSD

BUSD  Ren

Ren  OMG Network

OMG Network  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD