US Bitcoin ETFs hit 7-day losing streak, outflows surpass $1 billion

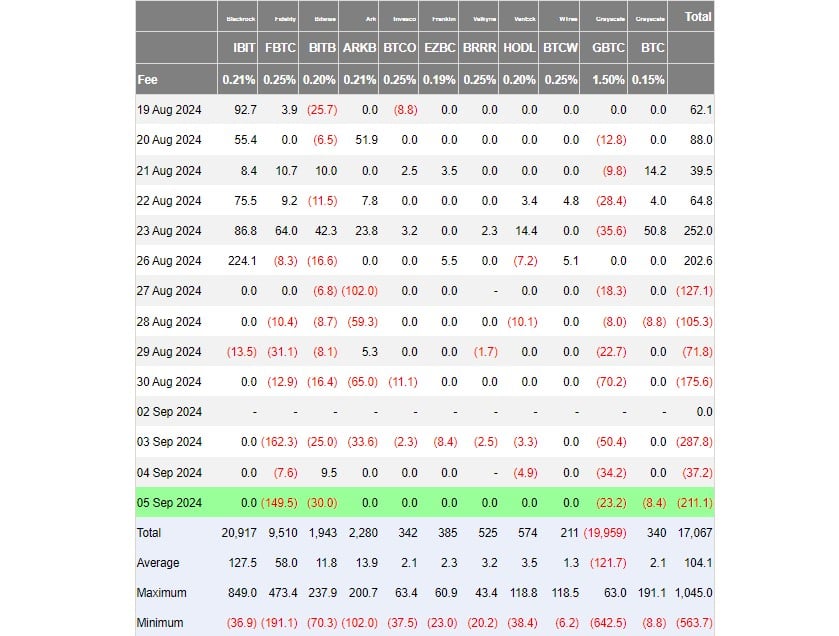

US spot Bitcoin exchange-traded funds (ETFs) endured net outflows for straight seven trading days, collectively shedding over $1 billion from August 27 to September 5, according to data from Farside Investors.

US Bitcoin ETFs hit $1B net outflows in 7 days

Notably, Fidelity’s Wise Origin Bitcoin Fund (FBTC) was the one that led the capital exit, not Grayscale’s Bitcoin ETF (GBTC). Approximately $374 million left FBTC over those seven days while GBTC posted $227 million in outflows.

The world’s largest Bitcoin ETF, BlackRock’s iShares Bitcoin Trust (IBIT), saw its second-ever outflow since its January launch, with investors withdrawing $13.5 million on August 29. IBIT has reported zero flows on other days during the stretch.

This marked a minor downturn from the fund’s previous performance, as it had seen consistent inflows in the weeks leading up to the stagnation.

Other US Bitcoin ETFs, except for WisdomTree’s Bitcoin Fund (BTCW), similarly reported losses, with no significant capital inflows during the period.

Bitcoin’s reversal is challenged amid ETF outflows and market fears

Bitcoin’s (BTC) recent price decline has been exacerbated by persistent ETF outflows and growing global market uncertainty. Thursday saw a major net outflow of $211 million from US Bitcoin funds, marking the fourth-highest daily outflow since May 1.

Bitcoin’s price has been unable to break above the $65,000 resistance level, leading to continued selling pressure. While long-term Bitcoin investors remain profitable, short-term holders are facing challenges in the current market conditions.

The fear and greed index remains firmly in the fear territory, reflecting broader market concerns about a potential recession.

Bitcoin’s price has dropped by over 4% in the past week, currently trading around $56,500, per TradingView’s data.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Cardano

Cardano  Dogecoin

Dogecoin  TRON

TRON  LEO Token

LEO Token  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Litecoin

Litecoin  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Dai

Dai  OKB

OKB  Gate

Gate  Ethereum Classic

Ethereum Classic  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Algorand

Algorand  KuCoin

KuCoin  Maker

Maker  Stacks

Stacks  Theta Network

Theta Network  Tether Gold

Tether Gold  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Zcash

Zcash  TrueUSD

TrueUSD  Polygon

Polygon  Synthetix Network

Synthetix Network  Dash

Dash  Zilliqa

Zilliqa  Qtum

Qtum  Basic Attention

Basic Attention  0x Protocol

0x Protocol  Holo

Holo  Decred

Decred  Siacoin

Siacoin  Ravencoin

Ravencoin  NEM

NEM  Enjin Coin

Enjin Coin  Waves

Waves  DigiByte

DigiByte  Nano

Nano  Ontology

Ontology  Hive

Hive  Lisk

Lisk  Status

Status  Numeraire

Numeraire  Pax Dollar

Pax Dollar  Huobi

Huobi  Steem

Steem  Bitcoin Gold

Bitcoin Gold  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Augur

Augur  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy