Wall Street Bitcoin Miner Loses $29 Million, Six Times Less Than Last Year

IREN (NASDAQ: IREN) just became yet another publicly-listed Bitcoin (BTC) miner from Wall Street, which significantly increased its revenue over the last year, benefiting from higher cryptocurrency prices. According to the results for the fiscal year ended June 30, 2024, revenues grew by 145%, and the number of mined BTC increased by 30%.

IREN Reduces Net Loss by Sixfold in 2024

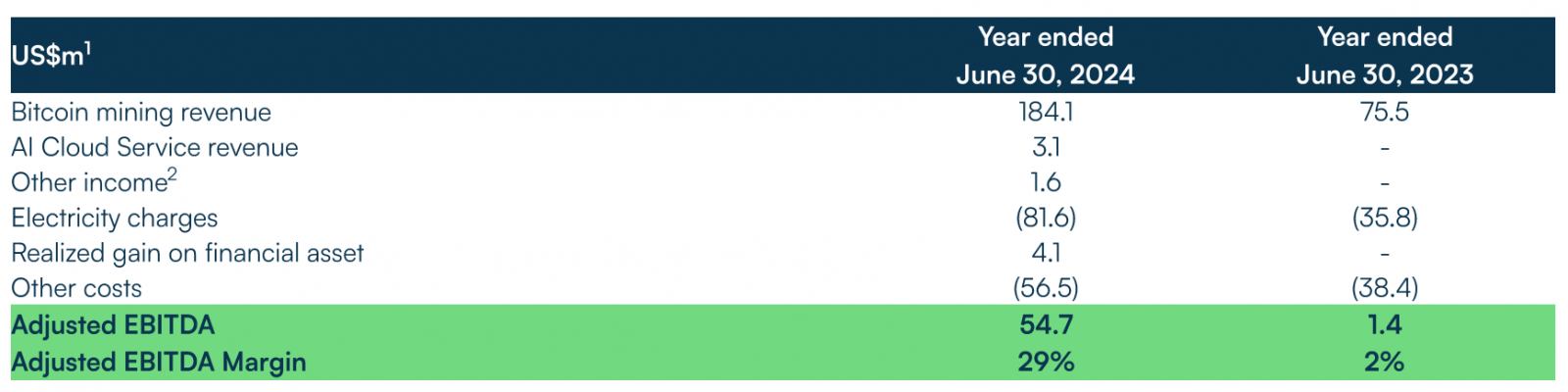

The company reported record Bitcoin mining revenue of $184.1 million, up from $75.5 million in the previous fiscal year. This substantial increase was driven by growth in operating hashrate and higher Bitcoin prices. IREN mined 4,191 Bitcoin during the year, compared to 3,259 in fiscal year 2023.

Adjusted EBITDA also saw a strong improvement, reaching $54.7 million, up from $1.4 million in the prior year. The company’s EBITDA turned positive at $19.6 million, compared to a loss of $123.2 million in fiscal year 2023.

Source: IREN

As a result, the net loss of nearly $172 million from the previous year was reduced to $29 million.

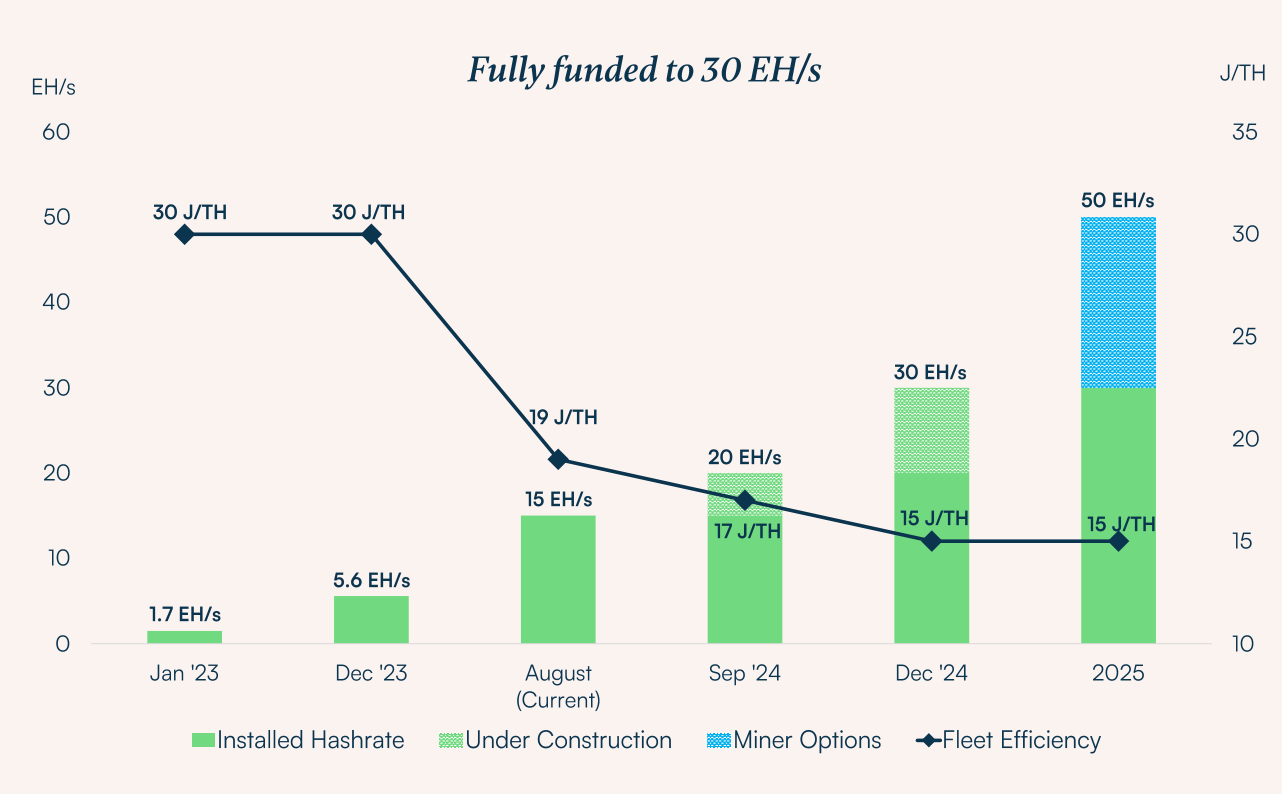

“We are pleased to report our full year FY24 results, which highlights continued growth across revenue, earnings and cashflow,” said Daniel Roberts, Co-Founder and Co-CEO of IREN. “Our 2024 guidance remains unchanged. With 15 EH/s installed, we are well on track to achieve our 20 EH/s milestone next month and 30 EH/s this year.”

Source: IREN

Among the companies that recently reported revenue growth is also Argo Blockchain. Its financial results grew by 18% in H1 2024 despite a 50% drop in the number of mined cryptocurrencies

AI Move

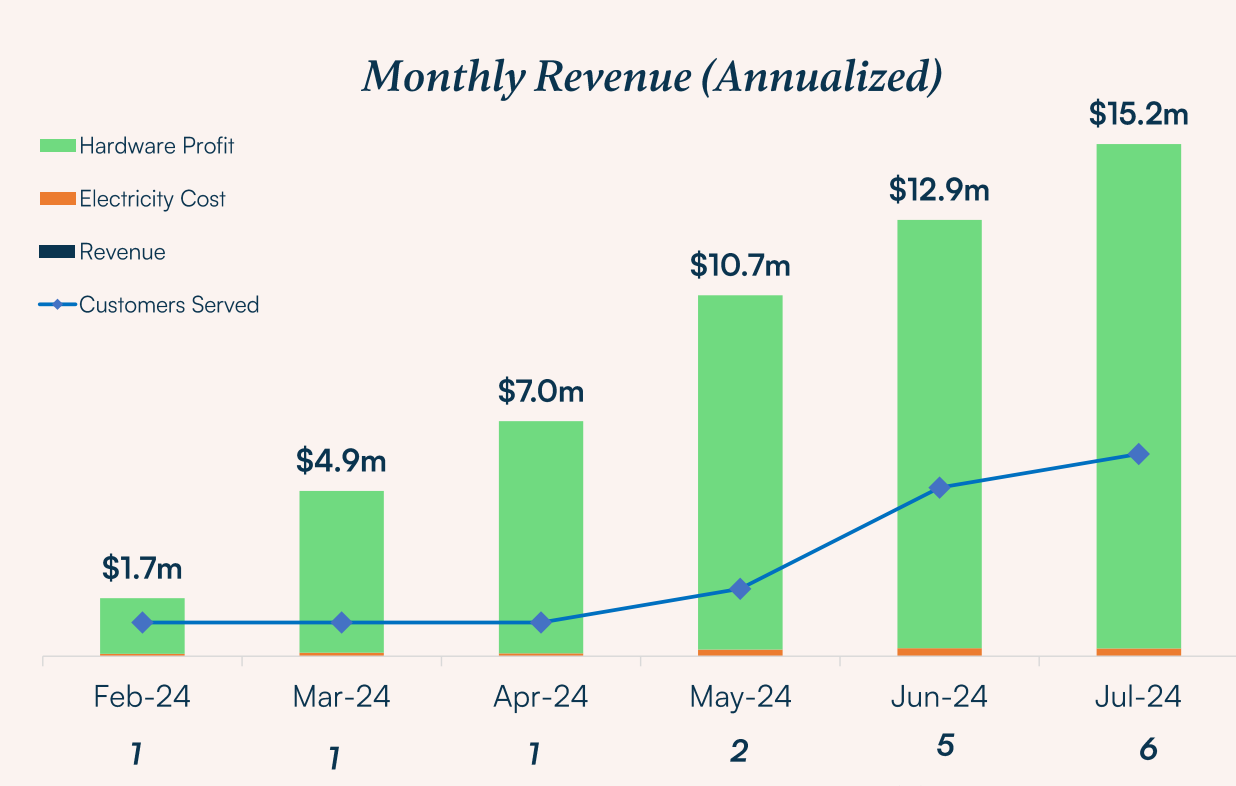

Similarly to a number of other companies in the sector recently, IREN also reported progress in its AI Cloud Services business, generating $3.1 million in revenue from multiple customers across reserved and on-demand markets.

Source: IREN

The company’s expansion plans remain on track, with data center capacity expected to reach 510MW by the end of 2024. IREN has also secured 2,310MW of grid-connected power over the last 12 months, positioning it for future growth.

Looking ahead, IREN is set to increase its Bitcoin mining capacity to 30 EH/s by the end of 2024, with 15 EH/s already installed. The company has also secured a pathway to reach 50 EH/s through existing purchase options for Bitmain S21 Pro miners.

Good results are one thing, however, Bitcoin mining gigants from Wall Street still feel the halving hangover. Their mining revenues in July fell by another 12%. This continues the negative reaction to April’s halving, which reduced block rewards, coupled with low network fees and rising production costs. According to the latest JPMorgan report, this is making it difficult for miners to maintain profitability.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Stellar

Stellar  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Dai

Dai  Hedera

Hedera  Stacks

Stacks  Monero

Monero  OKB

OKB  Cosmos Hub

Cosmos Hub  Algorand

Algorand  Theta Network

Theta Network  KuCoin

KuCoin  Maker

Maker  Gate

Gate  Polygon

Polygon  NEO

NEO  Tezos

Tezos  Zcash

Zcash  Tether Gold

Tether Gold  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Synthetix Network

Synthetix Network  TrueUSD

TrueUSD  Holo

Holo  Zilliqa

Zilliqa  Dash

Dash  0x Protocol

0x Protocol  Qtum

Qtum  Siacoin

Siacoin  Enjin Coin

Enjin Coin  Ravencoin

Ravencoin  Basic Attention

Basic Attention  Decred

Decred  Ontology

Ontology  NEM

NEM  DigiByte

DigiByte  Lisk

Lisk  Waves

Waves  Status

Status  Nano

Nano  Numeraire

Numeraire  Hive

Hive  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy