Wall Street Bitcoin Miners Report Lower November Production Despite BTC Rising to $100,000

Major Wall Street Bitcoin miners reported varied production results for November 2024, as network difficulty increased by 7% during the month, impacting mining efficiency and output across the industry.

Although last month the price of BTC reached record levels and nearly approached $100,000, competition, along with the time and costs required for cryptocurrency mining, also jumped visibly.

Bitcoin Reaches $100,000 but Wall Street Miners Report Mixed November

CleanSpark (NASDAQ: CLSK) maintained its position as one of the industry leader’s in November, producing 622 BTC, while Riot Platforms (NASDAQ: RIOT) followed with 495 BTC. Bitfarms (NASDAQ: BITF) and Cipher Mining (NASDAQ: CIFR) reported similar outputs of 204 and 202 BTC respectively, showcasing the tight competition in the mid-tier segment. TeraWulf (NASDAQ: WULF) rounded out the group with 115 BTC mined during the month.

Zach Bradford, CEO of CleanSpark

“Our teams have been relentlessly executing, making progress towards our year-end hashrate goal of 37 EH/s while improving our efficiency,” said CleanSpark CEO Zach Bradford.

Argo Blockchain (LSE: ARB, NASDAQ: ARBK), listed on both the London Stock Exchange and Wall Street, also reported its results, producing 39 BTC in November—a decline from the 46 BTC mined the previous month. However, mining revenues increased by $0.4 million, reaching $3.4 million.

How does this compare to October? For most of the mentioned companies, the result is worse. Last month, TeraWulf produced 150 BTC, Riot 505, and CleanSpark 655. The production decline observed across most miners reflects the challenging environment created by the network difficulty increase.

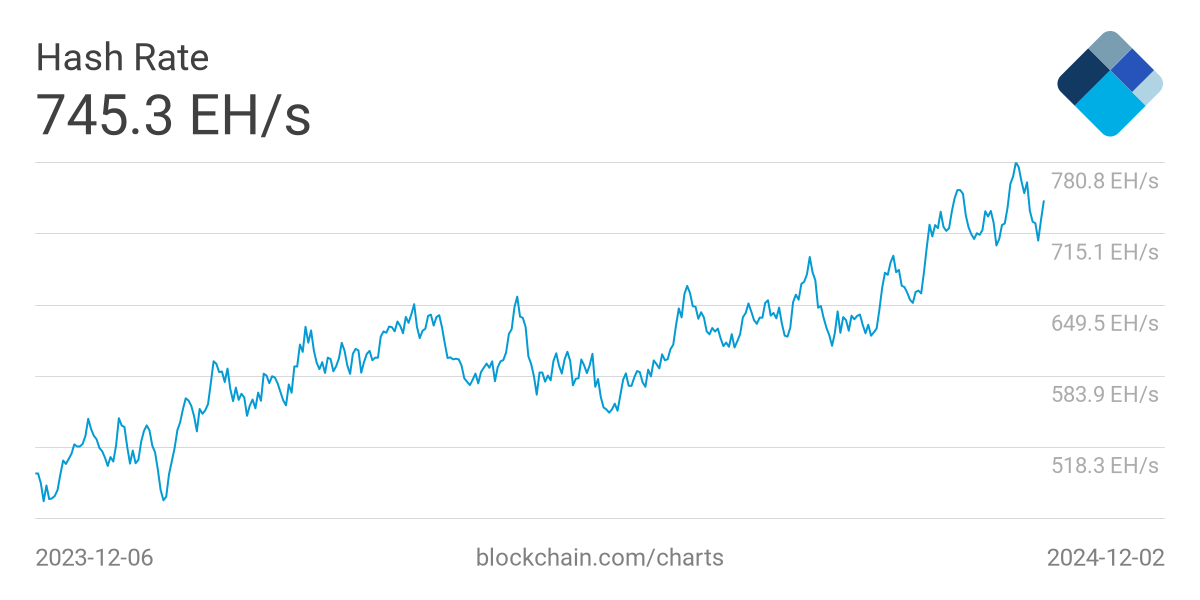

Total Hash Rate (TH/s) was up in November. Source: Blockchain.com

The day before, hover, MARA Holdings (NASDAQ: MARA), the largest publicly listed cryptocurrency mining company, reported a record Bitcoin production, with its output increasing by 26% to 907 BTC in November.

Fred Thiel, CEO, MARA, Source: LinkedIn

“November was a record-breaking month for MARA, with our mining operations achieving unprecedented levels of production. These results highlight the significant strides we’ve made in scaling operations and optimizing performance,” Fred Thiel, MARA’s chairman and CEO, noted.

Despite mining fewer tokens, miners earned more. According to the latest report from JPMorgan, aside from the fifth consecutive month of declining production, revenues increased by 24%. Meanwhile, the combined market capitalization of the 14 largest Bitcoin miners on Wall Street rose by 52%, reaching $36.2 billion.

Operational Developments and Hash Rate Expansion

Riot Platforms demonstrated visible growth in other areas than number of mined tokens, achieving a total deployed hash rate of 30.8 EH/s, marking a 148% increase year-over-year. The company’s expansion across multiple locations, including Rockdale, Corsicana, and Kentucky facilities, has strengthened its market position.

Jason Les, CEO of Riot Blockchain

“Stability in our production is a reflection of the ongoing operational improvements we continue to make, as demonstrated by our operating hash rate increasing 13% month-over-month compared to a 5% increase in our hash rate capacity,” commented Jason Les, the CEO of Riot. “Our work is not yet complete, and onsite teams continue deploying new miners and improving operations to increase our hash rate utilization further.”

Bitfarms also made notable progress in its North American expansion, with nearly 75% of its hashrate expected to come from North American data centers by the first half of 2025. The company’s operating hashrate reached 12.8 EH/s, representing a 100% increase from the previous year.

Cipher Mining continued its development at the Black Pearl data center, maintaining a steady operational hash rate of 12.0 EH/s. The company’s acquisition of the 100 MW Stingray site positions it for future growth, with a total potential power capacity exceeding 2.6 GW across 11 sites.

Tyler Page, CEO of of Ciper Mining

“By year-end, we expect to complete the Odessa upgrade, giving Cipher one of the most efficient fleets of mining rigs in the industry,” said Tyler Page, CEO of Cipher.

Mining companies are increasingly focused on fleet efficiency improvements. TeraWulf led the pack with an impressive 19.2 J/TH efficiency ratio, while Riot reported 22.3 J/TH. Bitfarms announced the upgrade of nearly 19,000 T21 miners to more efficient S21 Pro miners, expecting to achieve a 19 w/TH efficiency rate, representing a 10% improvement.

Treasury Management and Financial Strategy

Bitcoin holdings strategies varied significantly among operators. Riot maintained the largest treasury position with 11,425 BTC, representing a 55% increase year-over-year. Cipher Mining held 1,383 BTC, while Bitfarms reported 870 BTC in its treasury after transferring 351 Bitcoin to Bitmain as part of its miner upgrade agreement.

Miners also continued to optimize power costs through various strategies. Riot reported all-in power costs of 3.8c/kWh across its facilities, benefiting from $1.4 million in total power credits. Bitfarms maintained its commitment to renewable energy, with 256 MW of hydropower capacity supporting its operations.

Ben Gagnon, Source: Bitfarms’ Website

The competitive landscape is driving miners to explore diversification opportunities. Bitfarms noted increasing demand for immediate capacity in both HPC/AI and BTC mining, positioning itself to leverage its energy portfolio of over 950 MW in 2025 for strategic opportunities in both sectors.

“By redirecting our miners to be deployed in the United States, we have best matched our miners with the underlying electricity economics across our large portfolio of flexible MWs,” commented Ben Gagnon, the CEO of Bitfarms. “With demand for immediate capacity for both HPC/AI and BTC mining surging and based on discussions with strategic partners, I am confident that our energy portfolio of over 950 MW in 2025 gives us unparalleled flexibility to take advantage of strategic opportunities in both HPC/AI and BTC mining.”

Several companies announced leadership changes and strategic initiatives. Bitfarms appointed Andrew J. Chang as an Independent Director and announced the departure of its Chief Infrastructure Officer, while seeking new leadership with HPC/AI experience to support its evolving strategy.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Polygon

Polygon  Zcash

Zcash  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Qtum

Qtum  Siacoin

Siacoin  Basic Attention

Basic Attention  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  Ontology

Ontology  DigiByte

DigiByte  Nano

Nano  Status

Status  Hive

Hive  Huobi

Huobi  Lisk

Lisk  Waves

Waves  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom