Wall Street Estimates for US CPI and Core CPI, Bitcoin (BTC) Price To $45K or $55K?

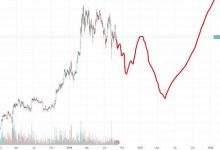

Crypto and stock market investors keenly await the consumer price index (CPI) inflation data for January by the U.S. Bureau of Labor Statistics for further cues on Fed rate cuts. Bitcoin price trades above $50,000 after a massive buying in spot Bitcoin ETFs, triggering a substantial crypto market rally.

CPI and Core CPI Expectations by Wall Street Giants

Wall Street giants expect a major fall in both CPI and core CPI inflation, especially after the recent CPI revision. While Fed officials are cautious on rate cuts in March, the upcoming economic data will guide better on the monetary policy outlook.

JPMorgan, Bank of America, UBS, Morgan Stanley, Citigroup, Deutsche Bank, Nomura, and RBC estimate headline CPI inflation cooling to 2.9% from 3.4%. However, Barclays, Goldman Sachs, TD Securities, and Wells Fargo anticipate a decline to 3%.

Whereas for core CPI, experts from banks including Citigroup, Deutsche Bank, JPMorgan, Morgan Stanley, and UBS estimate a drop to 3.7% from 3.9%. Moreover, Bank of America, Barclays, TD Securities and Nomura anticipate 3.8%, and Goldman Sachs expects a higher annual core rate of 3.9%.

Thus, the market estimated annual inflation rate cooling to 2.9% in January, which would be the lowest reading since March 2021. Also, annual core inflation is expected to slow to 3.7%, the lowest reading since April 2021. The estimates for monthly rates for both CPI and core CPI remain steady at 0.2% and 0.3%.

Bitcoin Price to $55,000?

The cooling CPI inflation will give the U.S. Federal Reserve proof to consider rate cuts in the months ahead. The CME FedWatch Tool shows an almost 50% probability of 25 bps rate cuts in May, with a high probability in June.

Macro data shows volatility these days, making it crucial for traders to keep a watch. The US dollar index (DXY) is falling from 104.25 to 104. A drop below 104 is what crypto traders expect for further upside move in BTC price to $55,000.

Moreover, the 10-year treasury yield (US10Y) is falling but remains above 4%. The recent treasury bills’ auctions and Fed officials’ cautious outlook on rate cuts.

The derivatives market looks strong as futures and options traders made fresh bets to further upside in BTC price. Bitcoin futures open interest rises over 7% to $47.32 billion, with futures volume rising 70% in the last 24 hours.

Total options open interest jump 4% to $24.29 billion after a massive 7.20% rise in CME BTC Futures open interest and massive inflow in spot Bitcoin ETFs.

Source: Deribit

Options traders making higher bets for $56K, $60K, and even $70K for February. It indicates BTC price likely staying above $50,000 after the CPI release.

BTC price jumped 4% in the past 24 hours, with the price currently trading at $50,100. The 24-hour low and high are $47,745 and $50,358, respectively. Furthermore, the trading volume shoots to almost 100% in the last 24 hours, indicating a rise in interest among traders.

Also Read:

- Peter Thiel-backed Founders Fund Invests A Massive $200 Million In Bitcoin and Ethereum

- Kraken Eyes To Enter Crypto ETF Custody Race Amid Spot Ethereum ETF Anticipation

- ETH Price Eyes Rally to $3,500 As Franklin Templeton Applies for Spot Ethereum ETF

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Zcash

Zcash  Polygon

Polygon  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Basic Attention

Basic Attention  Qtum

Qtum  Siacoin

Siacoin  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  DigiByte

DigiByte  Ontology

Ontology  Nano

Nano  Status

Status  Hive

Hive  Huobi

Huobi  Waves

Waves  Lisk

Lisk  Steem

Steem  Numeraire

Numeraire  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom