What Bitwise knows about Bitcoin’s $200,000 prediction and why it matters to you?

Could 2025 be the year Bitcoin hits $200,000, crypto unicorns debut on Wall Street, and tokenized assets go mainstream? Let’s understand why.

The crypto market in 2024 has been nothing short of transformative, with major milestones taking center stage throughout the year.

Against this backdrop, Bitwise has made a series of bold predictions for 2025, bringing into focus the next big trends in the industry.

Let’s dive into the details of each prediction and unravel the market conditions to assess how realistic these forecasts are and what they could mean for the future of the industry.

Table of Contents

- Bitcoin’s rise fueled by ETFs and adoption

- Coinbase and MicroStrategy’s market potential

- Crypto’s path into 401(k) plans

- Stablecoins and tokenized assets

- The road ahead

Bitcoin’s rise fueled by ETFs and adoption

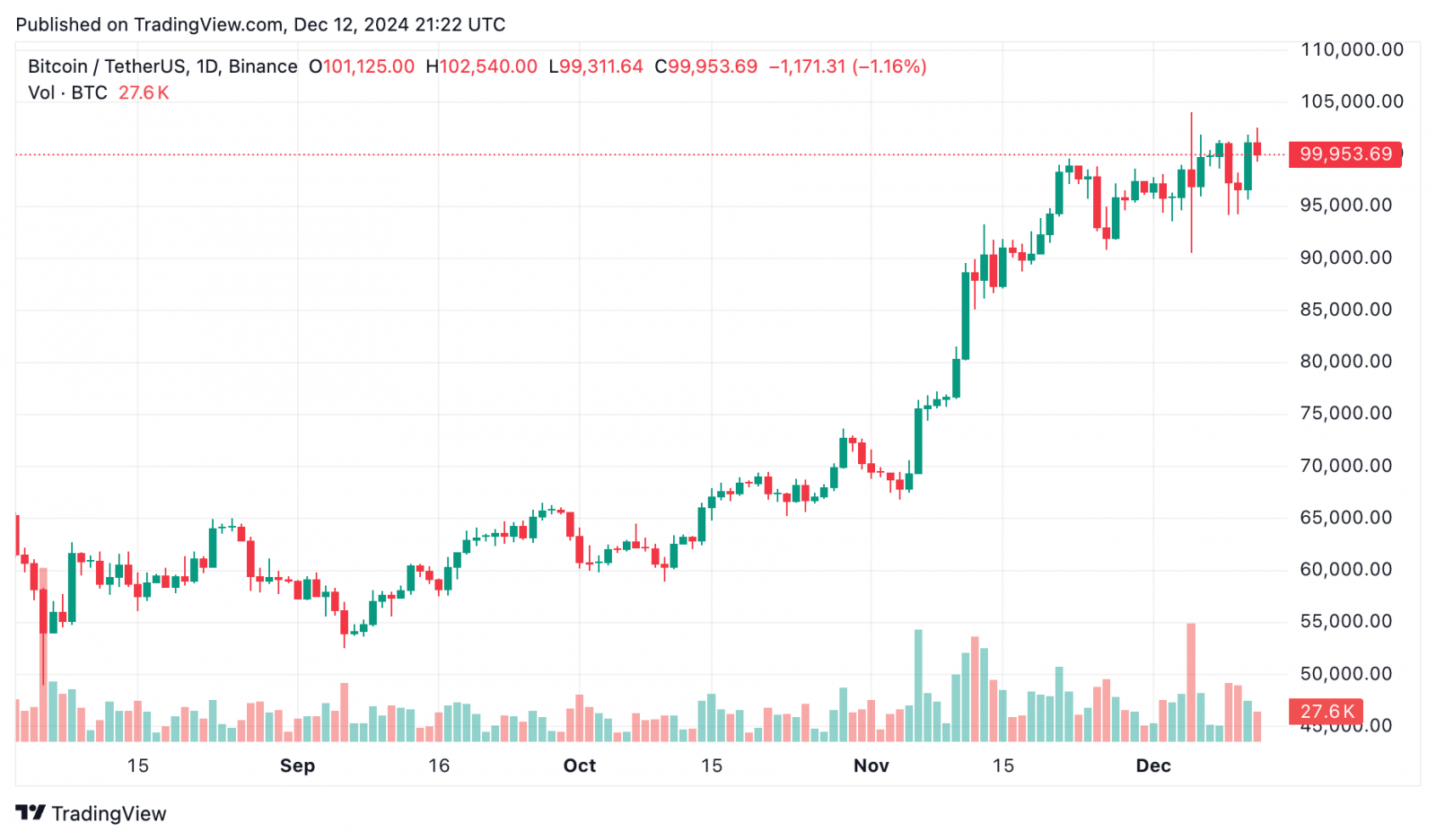

The first of these claims is that Bitcoin (BTC) will soar beyond $200,000 in 2025. To put this in perspective, Bitcoin is trading at $100,500 levels as of Dec. 12, a minor step back from its all-time high of $103,900 achieved just a week ago on Dec. 5.

BTC Price Chart | Source: crypto.news

This dip, marking a 3.5% retreat, comes on the heels of a broader market correction following an extraordinary bull run earlier in the year.

Bitcoin first broke its previous all-time high of $73,000 in March, setting off a wave of optimism that reached a crescendo in November when Donald Trump was elected the 47th President of the U.S.

His administration’s perceived pro-crypto stance has injected fresh confidence into the market. While the recent pullback may have tempered the frenzy, the overarching bullish sentiment remains intact.

Adding fuel to this optimism is the explosive growth in Bitcoin ETFs, which Bitwise predicts will attract even more inflows in 2025 than they did in 2024.

Since the launch of spot Bitcoin ETFs at the start of this year, total assets under management across these ETFs have reached an astonishing $113 billion as of Dec. 12, according to CoinGlass.

BlackRock’s iShares Bitcoin Trust (IBIT) has emerged as the frontrunner, drawing in the lion’s share of inflows. In just the past week, a record-breaking $3.85 billion flowed into digital asset funds, with BlackRock accounting for $2.6 billion of that total.

Bitwise’s third prediction ties closely to the first two, forecasting that the number of countries holding Bitcoin will double by 2025. The idea of nation-states accumulating Bitcoin is not new, but it is gaining traction as governments recognize its potential as a reserve asset.

Currently, eight nations hold Bitcoin, with the U.S. leading the pack with over 207,000 BTC, valued at more than $20.6 billion as of today. China follows closely, holding 194,000 BTC worth $19.3 billion.

Other notable holders include the United Kingdom, Ukraine, Bhutan, and El Salvador, with holdings ranging from a few thousand to tens of thousands of BTC. Collectively, all these nations control 529,558 BTC, which is roughly 2.52% of Bitcoin’s total supply of 21 million coins.

If the number of countries holding Bitcoin does indeed double, we could see a profound shift in geopolitical strategies, with Bitcoin serving as a new kind of reserve asset.

Coinbase and MicroStrategy’s market potential

Bitwise’s next set of predictions for 2025 claims that Coinbase (COIN) stock will exceed $700 per share by 2025. Currently trading at $313, Coinbase has seen a 100% year-to-date gain.

For context, Coinbase’s all-time high was $429.54, achieved during its debut on April 13, 2021, while its lowest point came on January 5, 2023, at $31.55.

From its all-time low to today’s price, the stock has surged by over 900%, showing a dramatic turnaround. However, achieving the predicted $700 mark would require an additional 120% increase.

Another fascinating prediction centers on Coinbase’s potential entry into the S&P 500 and MicroStrategy’s potential inclusion in the Nasdaq-100.

For Coinbase, joining the prestigious S&P 500 would signify its maturation as a blue-chip stock, reserved for companies with a market capitalization exceeding $18 billion and meeting specific profitability criteria.

While Coinbase has faced volatility since its IPO, its strong recovery in 2023 and consistent performance in 2024 make it a viable candidate for the index.

On the other hand, MicroStrategy’s transformation from a business software company to a corporate Bitcoin pioneer has redefined its market presence, with its stock price climbing 500% year-to-date, trading at $411 levels as of this writing, down from its 52-week high of $543.

The idea of MicroStrategy joining the Nasdaq-100 and possibly the S&P 500 has generated considerable buzz. According to Bloomberg ETF analyst Eric Balchunas, the company is a strong contender for the Nasdaq-100, with an announcement expected soon.

$MSTR is likely to be added to $QQQ on 12/23 (w/ announcement coming 12/13). Moderna likely to get boot (symbolic). Below is best guess of adds/drops via @JSeyff. Likely a 0.47% weight (40th biggest holding). There’s $550b of ETFs tracking the index. S&P 500 add next yr prob. pic.twitter.com/rmTavtvWQL

— Eric Balchunas (@EricBalchunas) December 10, 2024

However, its inclusion in the S&P 500 remains more challenging due to stricter criteria and the index committee’s selective approach.

Another exciting prediction for 2025 is that at least five crypto unicorns will go public in the U.S. With around 30 crypto unicorns currently operating in the U.S. — including well-known names like Ripple (XRP), OpenSea, and Chainalysis —t he pipeline for potential IPOs is robust.

An influx of crypto-related IPOs would not only provide new investment opportunities but also signal the sector’s maturation as it transitions from niche to mainstream.

Crypto’s path into 401(k) plans

Bitwise’s next prediction for 2025 revolves around the U.S. Department of Labor potentially relaxing its current guidance against including crypto in 401(k) retirement plans.

To understand the potential impact, it’s important to first unpack the current state of affairs and why crypto in retirement accounts has been a contentious issue.

As of now, the Department of Labor maintains a cautious stance toward crypto in retirement plans. In March 2022, the agency issued a compliance bulletin warning fiduciaries to exercise “extreme care” when allowing cryptocurrencies in 401(k) offerings.

The DOL raised concerns about the speculative nature of cryptocurrencies, their price volatility, regulatory uncertainties, and the risks of fraud and theft.

The agency argued that these factors make digital assets unsuitable for most retirement savers, whose investment horizons are long and whose risk tolerance is generally low.

Under this guidance, the inclusion of crypto in 401(k) plans has been rare. A few instances of integration, such as Fidelity’s introduction of a Bitcoin option for its 401(k) plans in 2022, faced immediate scrutiny.

The DOL cautioned Fidelity and other firms offering similar products to ensure compliance with fiduciary duties, effectively discouraging broader adoption.

Employers have been hesitant to expose themselves to potential liability, resulting in a limited presence of crypto within retirement portfolios.

If the prediction of relaxed guidance in 2025 comes true, it would mark a major policy reversal. Such a shift would likely be driven by growing demand from younger generations of workers who see crypto as a legitimate asset class.

Surveys have consistently shown that millennials and Gen Z investors view crypto as a vital component of their long-term financial strategies. For example, a 2023 Charles Schwab study found that 47% of millennials already hold crypto in some capacity, and 45% expressed interest in including it in their retirement accounts if given the option.

The potential market impact of this change is enormous. According to the Investment Company Institute, U.S. 401(k) plans held approximately $7.7 trillion in assets as of December 2023. Even a small percentage of this being allocated to cryptocurrencies could inject heavy liquidity into the market and further legitimize the space.

Stablecoins and tokenized assets

Bitwise’s predictions for 2025 also include a bold outlook on the stablecoin market and the tokenized real-world assets space.

The first projection foresees stablecoin assets doubling to over $400 billion, a substantial leap from their current market capitalization of $207 billion as of Dec. 12.

Tether (USDT) dominates this market with a commanding share of approximately 67.6%, backed by its $140 billion market cap.

USDT’s closest competitor, USD Coin (USDC), lags behind with a market cap of $41 billion, making it roughly 3.4 times smaller.

Stablecoins are frequently used as trading pairs on exchanges, providing a bridge between crypto assets and fiat currencies. Moreover, their role in facilitating cross-border transactions has also gained attention, particularly in regions with limited access to traditional banking services.

The second prediction centers on the tokenized real-world asset market, which is expected to reach $50 billion by 2025. According to a September 2024 Binance report, the total value of tokenized RWAs hit an all-time high of over $12 billion, excluding stablecoins.

On-chain real-world assets (“RWAs”) have reached an all-time high.

Our new report explores this recent growth, outlines key RWA categories, and provides a tech-driven tour of some of the most interesting protocols in the space.

Read on

https://t.co/1w8gr3Nrkg

— Binance Research (@BinanceResearch) September 13, 2024

RWAs refer to blockchain-based representations of physical and financial assets such as real estate, government bonds, commodities, and even fine art. Tokenization allows these assets to be divided into smaller units, making them more accessible to a wider range of investors.

Key categories in the RWA space include tokenized U.S. Treasuries, private credit, and real estate, with emerging categories such as carbon credits and air rights also gaining traction.

Traditional asset managers have already begun to tokenize illiquid assets like real estate or fine art to offer investors opportunities to diversify their holdings in ways that were previously challenging or cost-prohibitive.

A McKinsey report from June 2024 estimates that the tokenized market could grow to $2 trillion by 2030, underpinned by increasing demand for transparency, efficiency, and fractional ownership in financial markets.

The road ahead

The future of the crypto market looks exciting, with Bitwise’s 2025 predictions pointing to major shifts ahead. Bitcoin could hit new highs, stablecoins could double in value, and tokenized real-world assets could gain traction as the next big thing. But these changes will depend on how the market grows, how regulations evolve, and how technology keeps up.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Cardano

Cardano  Dogecoin

Dogecoin  TRON

TRON  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Hedera

Hedera  Litecoin

Litecoin  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Dai

Dai  OKB

OKB  Gate

Gate  Ethereum Classic

Ethereum Classic  VeChain

VeChain  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Algorand

Algorand  KuCoin

KuCoin  Maker

Maker  Stacks

Stacks  Theta Network

Theta Network  Tether Gold

Tether Gold  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Zcash

Zcash  TrueUSD

TrueUSD  Polygon

Polygon  Synthetix Network

Synthetix Network  Dash

Dash  Zilliqa

Zilliqa  Qtum

Qtum  Basic Attention

Basic Attention  0x Protocol

0x Protocol  Holo

Holo  Decred

Decred  Siacoin

Siacoin  Ravencoin

Ravencoin  NEM

NEM  Enjin Coin

Enjin Coin  DigiByte

DigiByte  Nano

Nano  Waves

Waves  Ontology

Ontology  Hive

Hive  Status

Status  Lisk

Lisk  Huobi

Huobi  Pax Dollar

Pax Dollar  Numeraire

Numeraire  Steem

Steem  BUSD

BUSD  Bitcoin Gold

Bitcoin Gold  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Augur

Augur  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy