Why the ETH bear case may be understuffed

Today, enjoy the Empire newsletter on Blockworks.co. Tomorrow, get the news delivered directly to your inbox. Subscribe to the Empire newsletter.

Are you ready to rumble?

Let’s talk about Ethereum.

There are, admittedly, a few strings I want to pull here. The first is a chart that caught my eye last week, and I haven’t gotten my mind off it.

Loading Tweet..

I reached out to RenMac, but didn’t hear back, unfortunately. So I sent the post to a few folks who I thought could weigh in with some insight into just how bearish ETH looks, if it really is that bad.

Jeff Sekinger, founder of Nurp, argued that the chart is actually bullish for ETH because it was able to find support after it bounced above $2,300.

Meanwhile, Cole Kennelly, founder of Volmex, told me that ETH’s fundamentals remain “strong.”

“Notably, ETH is the second crypto asset to have spot ETFs, the blockchain of choice for most institutional tokenization efforts, and the home to the leading stablecoins. ETH boasts the most extensive ecosystem of applications and blockchain developers, paving the way for its peers. Short-term price action is unpredictable, though long-term, ETH is certainly bullish in my opinion,” he continued.

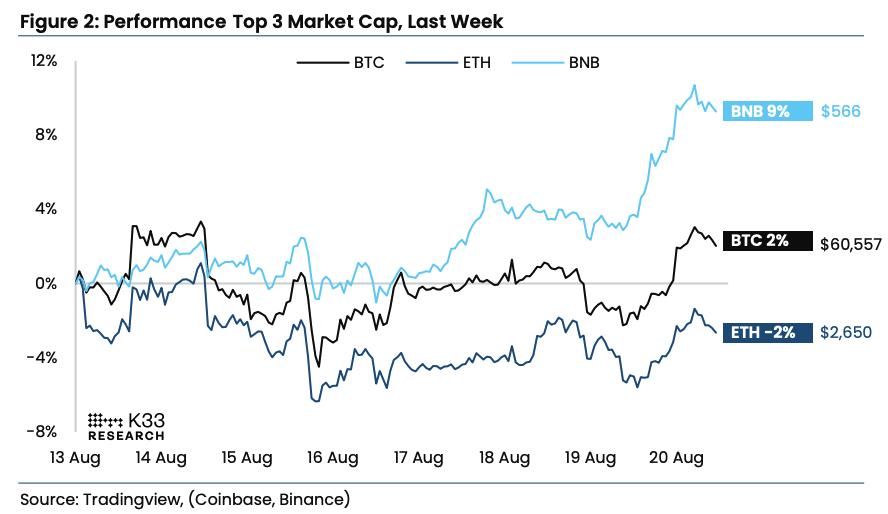

K33 Research, in a note published Tuesday, said ETH is underperforming due to “stagnant” ETF flows.

“However, if ETH ETF flows are to mirror the path of BTC ETFs, flows should pick up shortly,” analysts wrote.

Currently, CME futures premiums for ETH are trading at a “rare premium” to BTC.

“We note a majority of the recent increased exposure originates from the September contract, indicating long-biased traders expect a sustained upward trend for the weeks ahead,” they wrote.

Source: K33 Research

Volmex’s volatility indices, which measure the potential future volatility of both BTC and ETH over 30 days, show ETH at 67, and BTC at 57. To put that into perspective, the Ethereum Volmex Implied Volatility (EVIV) reading came in at 88 on Aug. 5 (remember the little crash in prices?), marking a high for the indices. ETH carved out a low of $2,100 that weekend, having opened the month at $3,200, before recovering to over $2,500.

“Lower volatility levels will ultimately depend on what happens next. Bullish price action could lead to a positive spot-volatility correlation, where implied volatility increases as the spot price increases. On the other hand, until various uncertainties in the market resolve, implied volatility levels could stay elevated,” Kennelly explained.

“Throughout most of 2023 and 2024, the EVIV – BVIV Index spread has been much lower, and even at times negative. Volmex’s BVRP and EVRP Indices (BTC and ETH Volatility Risk Premium Indices), which track the difference between 30-day implied volatility and realized volatility, are also around their lowest levels since the beginning of 2024.”

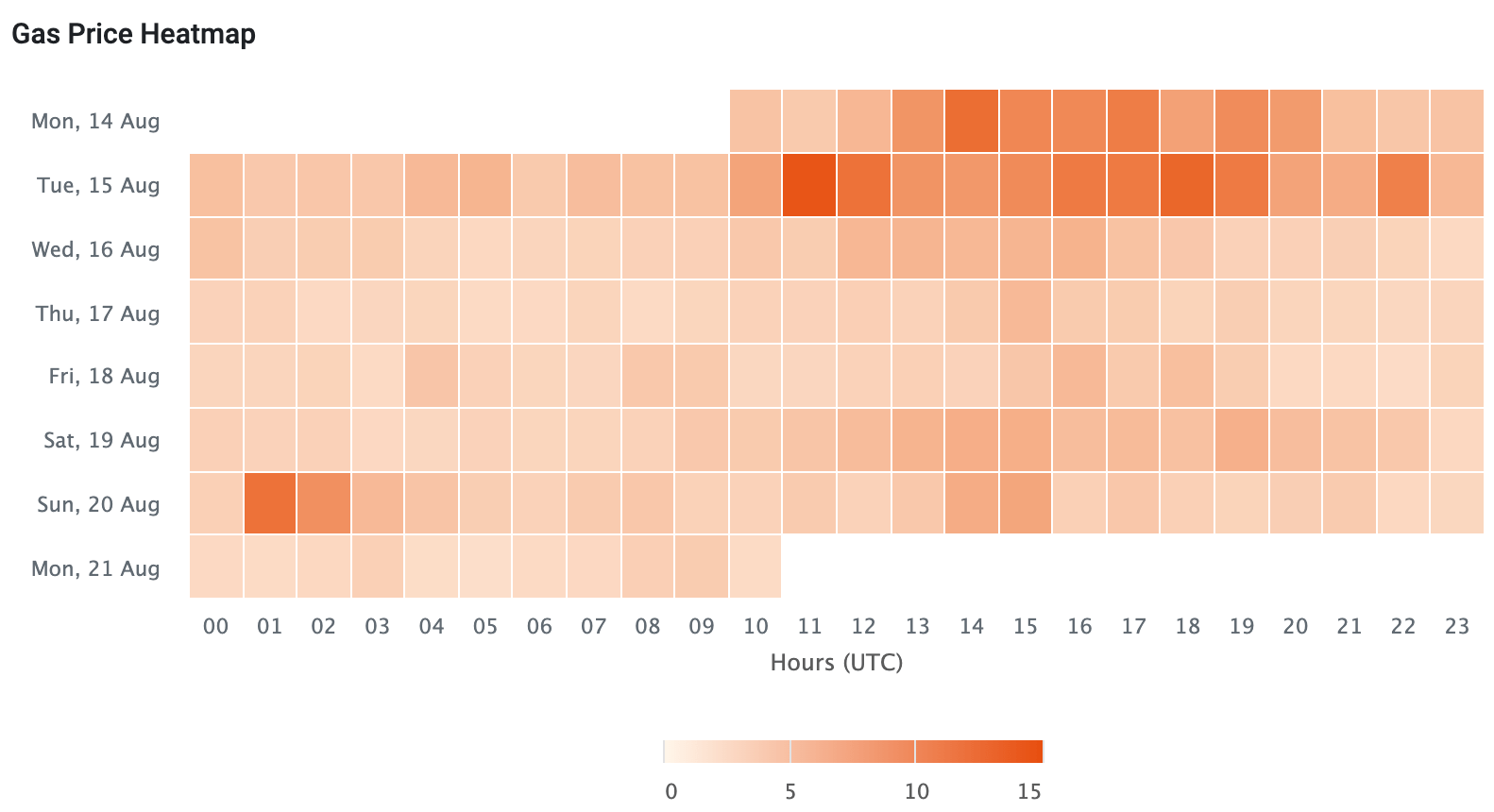

To add to all of this, ETH gas fees are incredibly low currently, like we’re talking decimal points low, per Etherscan.

Source: Etherscan

While that’s more of just an aside (because you should have seen my face when I was checking it yesterday), I think it feeds into the broader conversation.

All of this is to say that no one should be too worried about how ETH looks currently — it sits just under $2,600, which is 47% below its November 2021 high. But things are about to change. We’re wrapping up summer, which — as I’ve said before — means volumes should come back up as folks return to their desks.

Then we have the election and potential rate cuts….You know where I’m going with that, so we’ll leave it there.

But I will add that it looks like CME traders are entering the September contract “amidst growing premiums point towards long-biased traders employing medium-term strategies rather than short-time frame strategies. CME’s past tendency to lead market momentum makes this a tendency we will pay close attention to in the coming weeks,” as K33 noted.

LFG.

— Katherine Ross

Data Center

- ETH is down 2.7%, trading around $2,500. Bitcoin is floating just under $60,000, per Coinbase.

- ETH open interest on CEXs is at $10.69 billion, down 28% since this time last month.

- The crypto fear and greed index is showing fear at 26.

- Polygon and Hyperliquid TVLs have grown the most out of networks with $500 million or more — around 6% in the past week to $888 million and $718 million, respectively.

- Base DEX volumes are down 19% week-on-week, per DeFiLlama. August is on track to come in below July’s $15.6 billion.

Paint by lawsuits

If things are feeling a little quiet — too quiet — then perhaps you’re just missing the SEC.

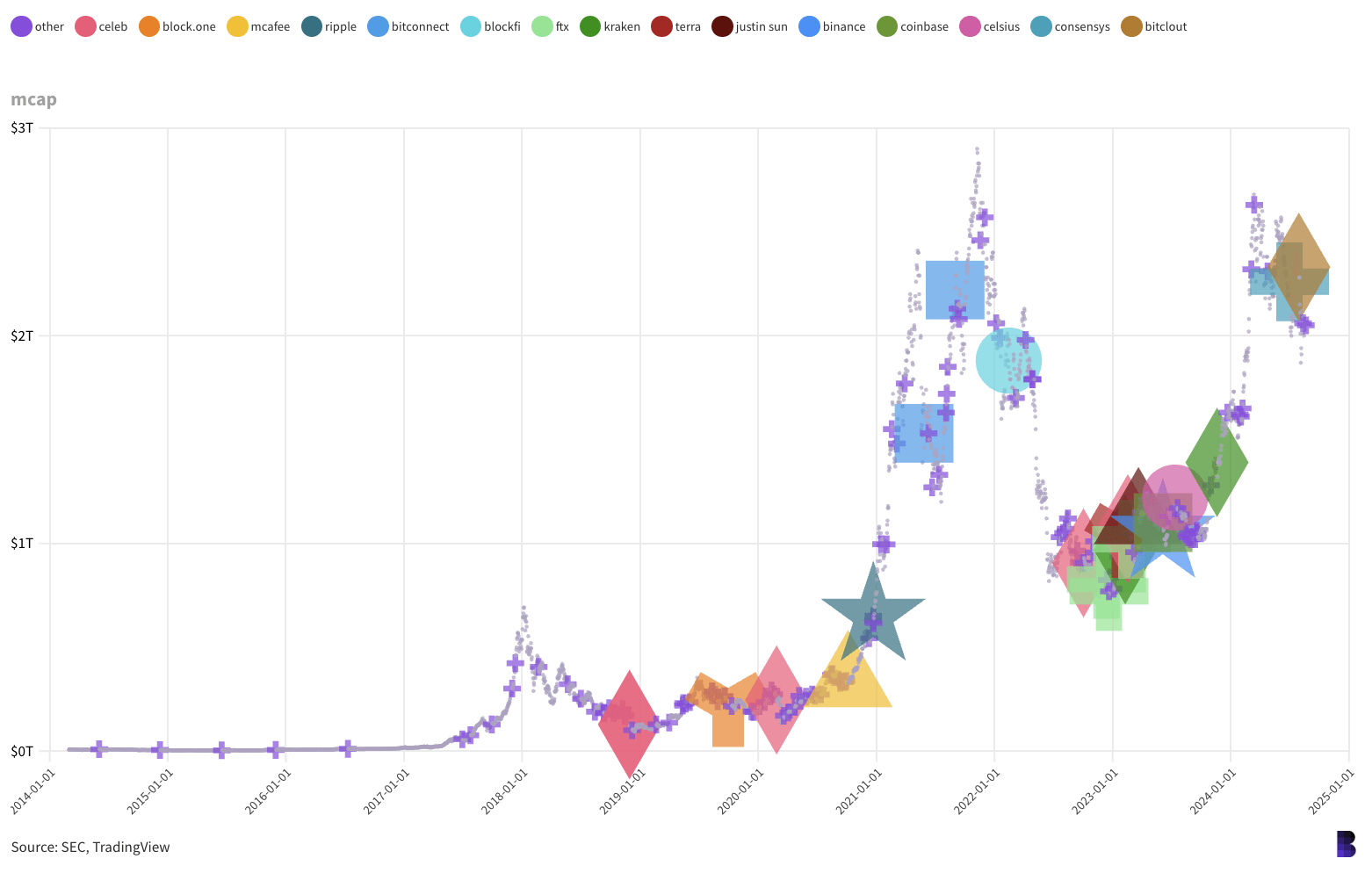

Gensler’s agency has been gungho about suing crypto startups, founders and other entities over the past few years. Ripple, Kraken, Coinbase, Binance, Justin Sun, Consensys and Block.one have all been on the receiving end, with some cases still ongoing.

Among those suits have been plenty of unquestionable cases brought against legitimate fraudsters, misappropriators and Ponzi schemers.

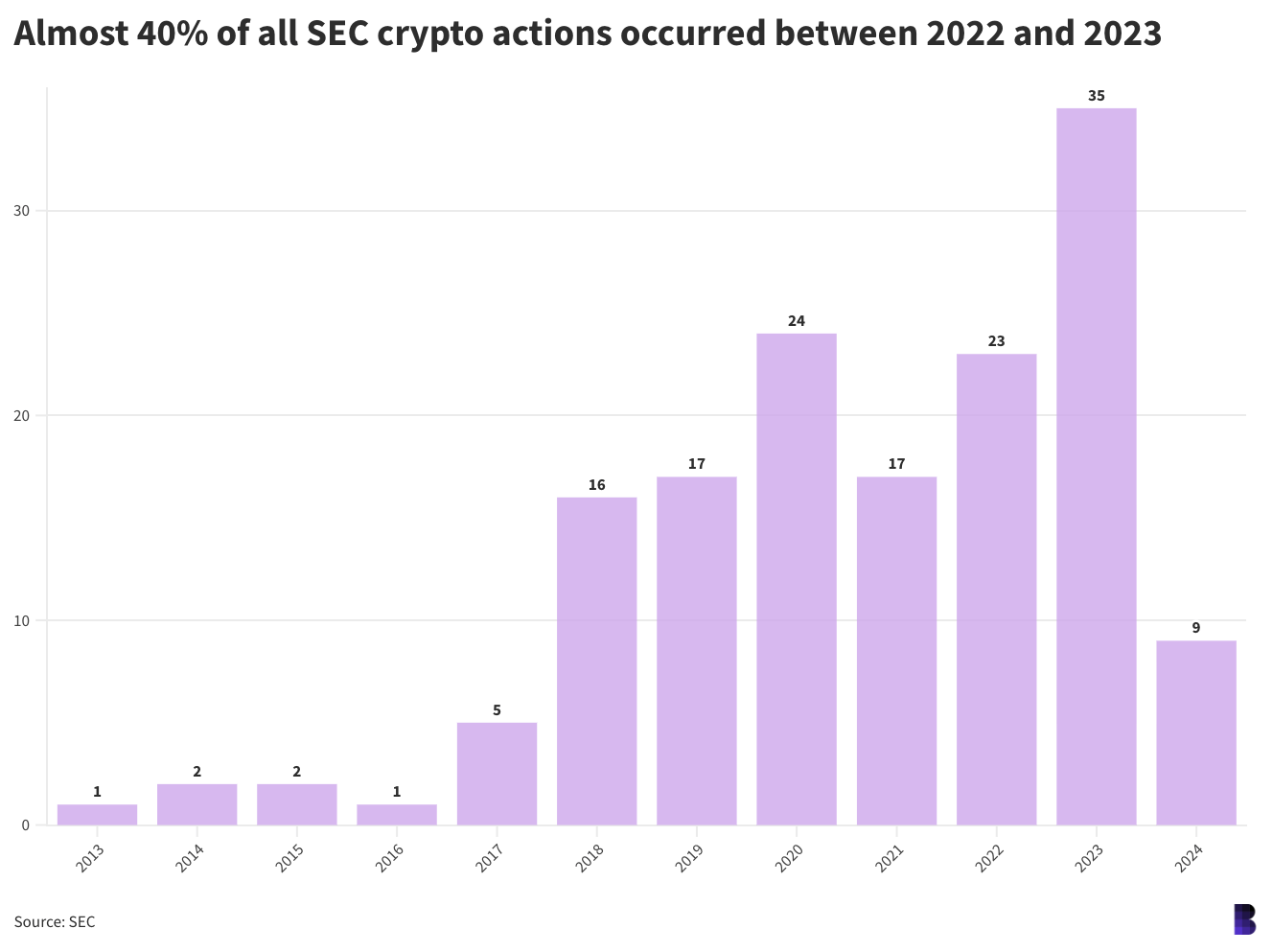

But the rate of SEC actions has slowed dramatically over the past eight months. The SEC compiles a list of crypto actions on its website that totals to 152, and 58 of those were brought between 2022 and 2023.

This year to date, there have only been nine. Quick math shows the SEC has, on average, brought 23 crypto-related actions per year since 2019 — almost two per month, annualized.

Apparently, bear markets are for building SEC lawsuits

The chart above plots SEC crypto actions against the total crypto market cap since 2014 (the first SEC case was brought one year earlier, but TradingView’s index doesn’t go back that far).

The large colorful shapes represent more high profile SEC cases, the ones mentioned above as well as Terra, McAfee, BitConnect and some others. Purple diamonds are for anything involving a celebrity.

Smaller purple triangles are other actions, ranging from investment fraud to LBRY, Kik, ShapeShift and the Coinbase insider trader.

To match its average rate over the past five years, we should have seen 15 SEC lawsuits and other reproaches since January. And every year, around now, crypto anticipates a potential flurry of cases coming out of the SEC.

The US government’s fiscal year ends on September 30 — so hypothetically, if the SEC has cases to bring forward that were included in this fiscal year’s budget, then we should see those drop sometime over the next six weeks.

But if the SEC doesn’t have a bevy of cases in the can, perhaps the lower number this year reflects a shift in priority to the big fish.

Uniswap Labs could be among the next major entities to be sued, with the Brooklyn-headquartered firm receiving a Wells notice in April. A report from Axios earlier this month suggests that the SEC is still poking around after it started asking venture capitalists about the firm.

Perhaps there’s fewer cases to bring. Or just maybe, the SEC hasn’t been so keen to go out on a limb out since the DEBT Box fiasco.

— David Canellis

The Works

- Bitfarms is acquiring Stronghold Digital for $175 million in stock and debt.

- According to Arkham Intelligence, Mt. Gox moved over $780 million of bitcoin overnight. The BTC hasn’t moved since.

- Institutional investors could own up to 10% of all bitcoin, Bitwise CIO Matt Hougan noted.

- CryptoQuant said the overall declining monthly growth rate of bitcoin whale holdings is a bearish indicator.

- Exodus legal chief Veronica McGregor told Blockworks that a potential reset on crypto from the Kamala Harris campaign will take time.

The Riff

Q: Is the crypto dream still alive?

The best part about crypto is that some of its most lofty dreams have already come true.

A sovereign country adopted bitcoin as a legal tender. BlackRock and Franklin Templeton use Ethereum every day to pay yield on tokenized money markets. Multimillion-dollar NFTs are bought and sold at Sotheby’s and Christie’s, and mortgages have been backed with bitcoin.

The CFTC even agrees that bitcoin and ether are commodities — making crypto as legitimate on the financial market as copper, oil, wheat and gold.

And OK, a US agency might knock on your door if you code a little too much privacy into your crypto.

Does that mean the crypto-privacy dream is dead? I hope not.

— David Canellis

Heck yeah.

While things are definitely changing and evolving throughout crypto, the hype and momentum remain even though this summer has been so slow.

I think that’s a really positive sign, personally. Add to that the conversations I’m having with folks every day about how they’re building, developing and preparing the space for more adoption and improving use cases for folks, and it’s easy to give you a positive answer here.

The glow-up post FTX is unreal. Let’s keep it going, folks.

— Katherine Ross

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Zcash

Zcash  Polygon

Polygon  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Qtum

Qtum  Siacoin

Siacoin  Basic Attention

Basic Attention  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  DigiByte

DigiByte  Ontology

Ontology  Nano

Nano  Status

Status  Waves

Waves  Huobi

Huobi  Lisk

Lisk  Hive

Hive  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom