XRP Drops 11% After SEC Appeal; Can It Rebound to $0.66?

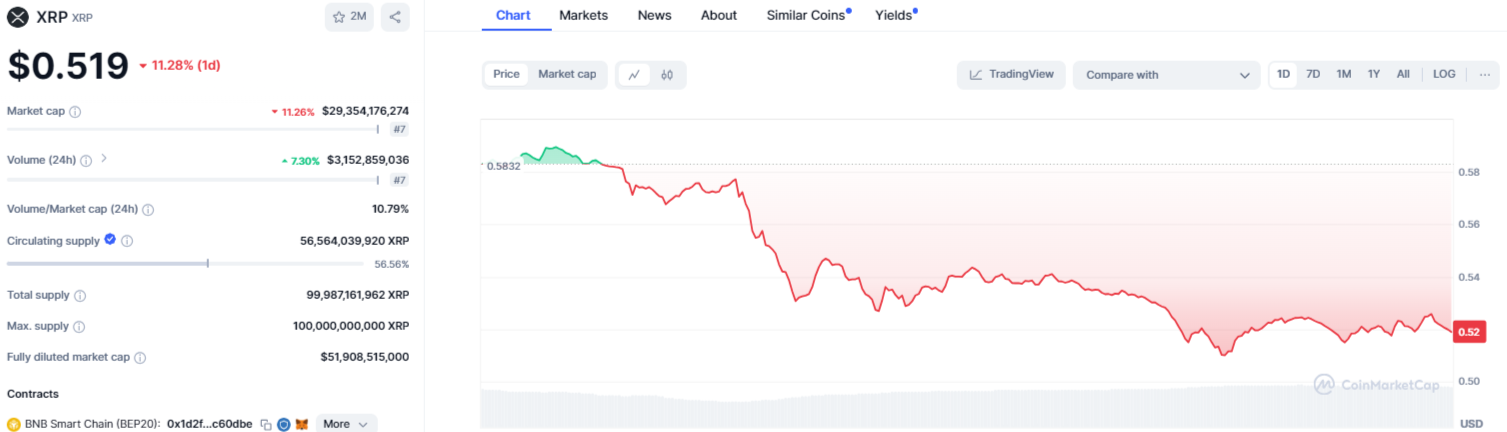

Ripple’s native token, XRP, saw a sudden price drop on Wednesday, October 2, after the U.S. SEC filed an appeal against a court ruling that had previously worked in Ripple’s favor. This impulsive reversal wiped out 11% of the cryptocurrency’s value, causing it to fall from its recent high of $0.66 to a low of $0.5075. The slip marked a stark contrast to the earlier optimism among investors, who had anticipated a possible bullish breakout for the cryptocurrency.

Notably, the timing of the appeal comes after XRP’s brief bull run earlier in the week, when it challenged its resistance level around the $0.66 mark, a price last seen in mid-March 2023. However, with the SEC’s legal maneuver, altcoin investors have been left wondering whether the token can bounce back and reclaim its lost ground.

Following the appeal, XRP’s market capitalization dropped to $29.354 billion, though the token still held its position as the seventh-largest cryptocurrency by market cap. While the token’s price stumbled, its trading volume surged. Within 24 hours, trading activity climbed by over 7.30%, hitting $3.15 billion.

This increase in volume can be attributed mainly to profit-taking as market participants reacted to the renewed regulatory uncertainty surrounding Ripple’s ongoing legal battle with the SEC, adding to the volatility in the cryptocurrency’s market performance.

Ripple’s Legal Response and Implications

The SEC’s appeal was submitted to the Second Circuit Court of Appeals in Manhattan on Wednesday, following a decision by Judge Analisa Torres in July 2023. That ruling determined that Ripple had violated federal securities laws through institutional sales of XRP, resulting in a $125 million penalty, a far cry from the $2 billion the SEC initially sought.

(1) The SEC’s decision to appeal is disappointing, but not surprising. This just prolongs what’s already a complete embarrassment for the agency. The Court already rejected the SEC’s suggestion that Ripple acted recklessly, and there were no allegations of fraud and, of course,… https://t.co/PQozMMtthf

— Stuart Alderoty (@s_alderoty) October 2, 2024

In response to this appeal, Ripple’s chief legal officer, Stuart Alderoty, expressed disappointment but noted the appeal was expected. According to reports, Ripple is considering filing a cross-appeal, maintaining that the SEC’s lawsuit is irrational and misguided. Meanwhile, the cryptocurrency’s market outlook remains skeptical, with price fluctuations expected as regulatory developments continue to unfold.

Technical Analysis: XRP’s Chart Patterns Signal Consolidation

On the technical side, XRP’s recent price action reveals a symmetrical triangle on the weekly chart. This pattern, created by a series of lower highs and higher lows, generally points to a consolidation period. The token’s price movement within this formation will likely remain constrained until a decisive breakout occurs.

On the other hand, indicators like the RSI and the MACD show signs of possible further downside. Standing at 47.24, the RSI has dipped below the signal line, suggesting a bearish trend. Similarly, the MACD line is nearing a crossover with its signal line, implying a possible shift in momentum. These indicators point to a cautious market stance, with traders expecting further price consolidation before any major movement occurs.

Key Support and Resistance Levels

XRP’s immediate support level now hovers around the $0.50 mark. Should this support fail, analysts warn that the token could slip to $0.43, with a further decline potentially leading it back to its July low of $0.38. On the flip side, if XRP can break above the symmetrical triangle, it may retest the key resistance levels of $0.66 and $0.74.

However, in the event of a favorable legal outcome for Ripple in the SEC appeal, the cryptocurrency could rally sharply, with bullish projections targeting the $1.0 level. However, until more clarity emerges from the legal proceedings, the altcoin’s price movement will likely remain heavily influenced by regulatory news and broader market sentiment.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Cardano

Cardano  Dogecoin

Dogecoin  TRON

TRON  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Hedera

Hedera  Litecoin

Litecoin  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Dai

Dai  OKB

OKB  Gate

Gate  Ethereum Classic

Ethereum Classic  Cronos

Cronos  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Algorand

Algorand  KuCoin

KuCoin  Maker

Maker  Stacks

Stacks  Theta Network

Theta Network  Tether Gold

Tether Gold  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Zcash

Zcash  TrueUSD

TrueUSD  Polygon

Polygon  Synthetix Network

Synthetix Network  Dash

Dash  Zilliqa

Zilliqa  Qtum

Qtum  0x Protocol

0x Protocol  Basic Attention

Basic Attention  Decred

Decred  Holo

Holo  Siacoin

Siacoin  Ravencoin

Ravencoin  NEM

NEM  Enjin Coin

Enjin Coin  DigiByte

DigiByte  Ontology

Ontology  Nano

Nano  Waves

Waves  Hive

Hive  Lisk

Lisk  Status

Status  Huobi

Huobi  Pax Dollar

Pax Dollar  Numeraire

Numeraire  Steem

Steem  BUSD

BUSD  Bitcoin Gold

Bitcoin Gold  OMG Network

OMG Network  Bitcoin Diamond

Bitcoin Diamond  Ren

Ren  Augur

Augur  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy