XRP Market Update: Bullish Surge Hints at Explosive Breakout Potential

XRP was trading at $2.45 on Jan. 4, 2025, boasting a market capitalization of $140.85 billion. Its 24-hour trading volume reached $4.47 billion, and the day’s price movement ranged between $2.43 and $2.49.

XRP

XRP’s one-hour chart illustrates a phase of consolidation within the $2.45 to $2.50 range, suggesting a possible breakout scenario. Low trading activity in this zone implies that market participants are waiting for a directional cue. With resistance set at $2.50 and support at $2.40, a decisive move above $2.50, backed by significant volume, could present a buying opportunity. A measured profit-taking strategy might focus on the $2.60 mark.

XRP 1H chart on Jan. 4, 2025.

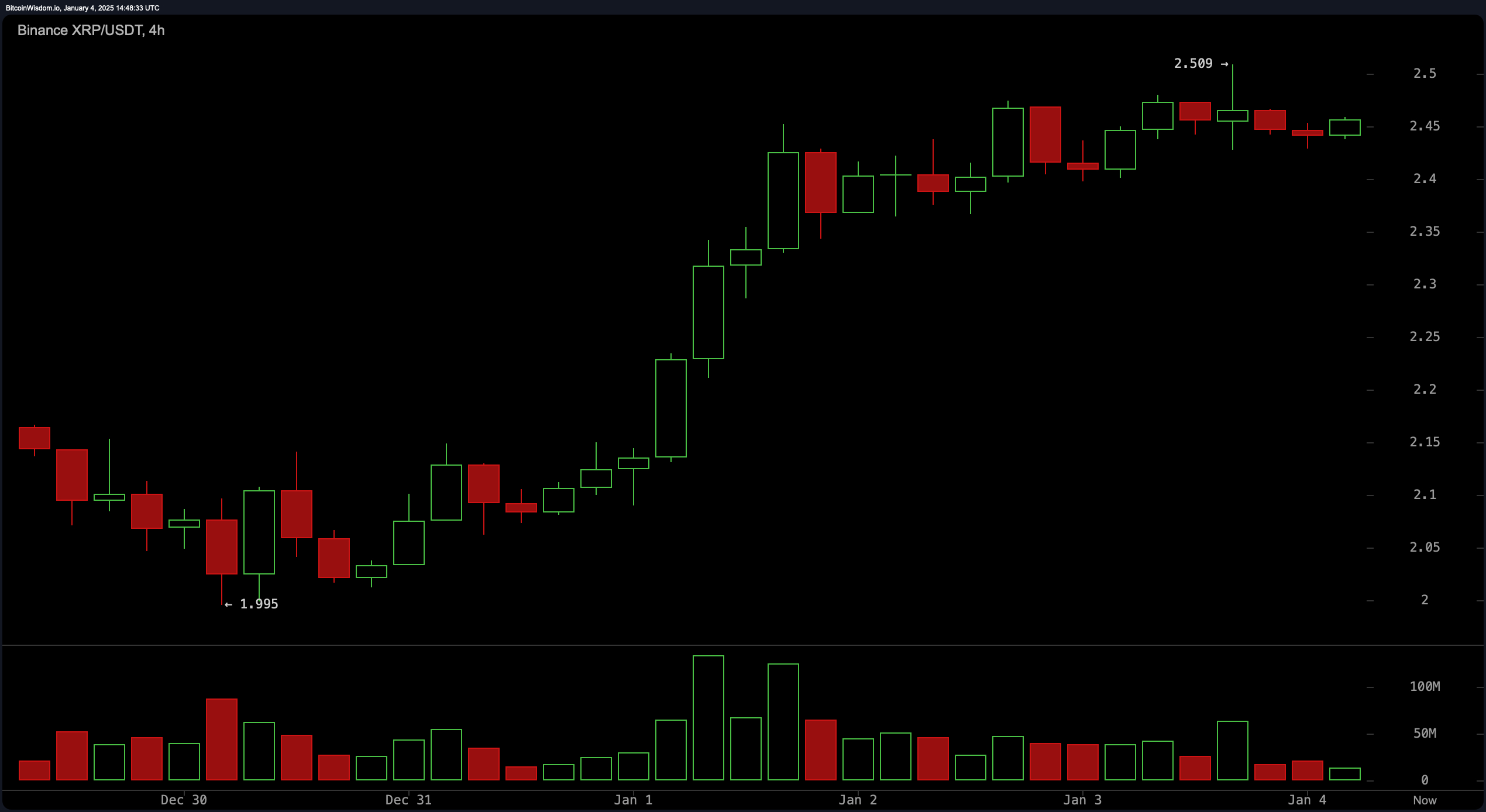

XRP’s four-hour chart emphasizes a consistent uptrend, interrupted only by brief consolidations below $2.50. Bullish candlesticks and synchronized volume surges highlight steady momentum. Key levels include short-term resistance at $2.50 and support at $2.20. A breakout above the consolidation point near $2.30 could mark an attractive entry, with targets extending toward $2.50 and beyond.

XRP 4H chart on Jan. 4, 2025.

On the daily chart, XRP maintains its upward trajectory, forming progressively higher lows and highs. A broader range is defined by resistance at $2.90 and support at $2.00. Significant buying activity accompanies upward price movements, while a pullback to $2.20–$2.30 could offer potential entry points. Resistance zones near $2.75–$2.90 may serve as profit-taking opportunities.

XRP Daily chart on Jan. 4, 2025.

Oscillator readings provide mixed insights. The relative strength index (RSI) sits at 61.66, suggesting neutrality, while the stochastic oscillator at 91.92 and the commodity channel index (CCI) at 113.03 similarly indicate balanced conditions. Meanwhile, momentum at 0.162 and the moving average convergence divergence (MACD) at 0.072 lean toward a favorable buying outlook.

Moving averages (MAs) reinforce bullish sentiment across short- and long-term indicators, with both exponential (EMA) and simple moving averages (SMA) aligning on a buy signal across multiple timeframes. A word of caution stems from the hull moving average (HMA) at 2.49876, urging close attention to price dynamics in this range.

Bull Verdict:

XRP’s technical indicators and price action suggest a bullish outlook, with strong support levels, consistent buy signals from moving averages, and momentum favoring upward movement. A breakout above $2.50 could pave the way to test resistance near $2.75 or even $2.90, offering substantial upside potential for traders.

Bear Verdict:

Despite the bullish signals, XRP’s consolidation near key resistance and low volume in critical ranges raise caution. A failure to break above $2.50, combined with potential sell signals like the HMA, could trigger a reversal, testing support near $2.40 or lower.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Hedera

Hedera  Litecoin

Litecoin  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Dai

Dai  OKB

OKB  Gate

Gate  Cronos

Cronos  Ethereum Classic

Ethereum Classic  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Algorand

Algorand  KuCoin

KuCoin  Maker

Maker  Stacks

Stacks  Theta Network

Theta Network  Tezos

Tezos  Tether Gold

Tether Gold  IOTA

IOTA  Zcash

Zcash  NEO

NEO  TrueUSD

TrueUSD  Polygon

Polygon  Synthetix Network

Synthetix Network  Dash

Dash  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Qtum

Qtum  Basic Attention

Basic Attention  Decred

Decred  Holo

Holo  DigiByte

DigiByte  Siacoin

Siacoin  Ravencoin

Ravencoin  Enjin Coin

Enjin Coin  NEM

NEM  Nano

Nano  Ontology

Ontology  Waves

Waves  Hive

Hive  Lisk

Lisk  Status

Status  Pax Dollar

Pax Dollar  Huobi

Huobi  Numeraire

Numeraire  Steem

Steem  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bitcoin Gold

Bitcoin Gold  Augur

Augur  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy